時間:2024-04-09|瀏覽:473

比特幣的算力不會下降那么多

與普遍看法相反,減半可能不會導致網絡算力大幅下降。比特幣前三次減半后,算力暴跌了 25%、11% 和 25%,看來許多分析師和礦工都預計(或希望?)這次算力也會出現類似的下降。

我同意 Pennyether 的預測,即即將到來的比特幣減半預計將導致算力小幅下降,幅度為 5% 到 10%。這一預測也與算力指數的 3-7% 的預測相差不遠。

這一謹慎的預測源于目前比特幣挖礦的高盈利能力,這是由其高價格推動的,并且觀察到,大約 70% 的比特幣算力是自 2022 年 1 月以來引入的,在挖礦經濟條件下運行,有時不如現在預期的那樣有利。 -減半。

此外,預計算力將從這次小幅下跌中迅速反彈。在過去的三次減半中,網絡平均在 57 天內恢復了減半前的算力水平。這一趨勢凸顯了一個重要的觀點: 減半不應被視為降低算力的事件,而應被視為算力不斷上升軌跡中的短暫暫停。

礦工不斷努力用最新、最高效的型號更新設備,進一步增強了算力的穩健性。預計這一策略不僅可以抵消算力的短期下降,而且還可能導致未來幾個月算力的大幅上升。

從本質上講,即將到來的比特幣減半可能只是網絡算力軌跡中的一個短暫的小問題,而不是一次重大挫折。

高成本礦工將被迫升級車隊

CoinMetrics 的數據突顯出,大多數行業目前都在使用效率相對較低的機器,例如 Antminer S19J Pro。這些礦商需要 0.05 美元/千瓦時或更低的運營成本才能在減半后保持健康的毛利率。

然而,根據算力指數,美國的平均托管率略低于 0.08 美元/kWh,許多美國礦商在減半后可能面臨現金流挑戰,從而被迫進行大規模的設備升級。

比特大陸推出的新機器,包括 S21、T21 和 S21 Pro(每臺機器的效率都低于 20 J/TH),正好趕上減半。這一發展促使許多美國托管提供商推動其客戶從 S19J Pro 切換到 S21 型號。考慮到美國高昂的托管費用,這種推動可以被視為一種必然,而不是一種選擇。

Referring to the chart above, it's evident that the S19J Pro models are unlikely to generate positive cash flow when hosted at $0.08 per kWh, considering their direct bitcoin production cost stands at $75,000. Thus, miners facing higher operational expenses must transition to more efficient hardware, such as the Antminer S21 or similar models, to maintain profitability.

While upgrading to the latest machines allows operations to continue even in high-cost environments, it's hardly a viable long-term strategy. The necessity to constantly update hardware, often before the previous investments are recouped, underscores the unsustainability of such an approach.

My underlying message is clear: if you need to use the latest-generation hardware to stay cash flow positive, your operating costs are too high.

Miners will find creative ways to increase profits

Bitcoin mining is one of the most free and competitive markets globally, a market that Adam Smith himself would admire. This inherent competitiveness fuels a relentless pursuit of innovation, especially during challenging periods such as the halving events. In response to the pressures exerted by the halving, miners are adopting some of the most inventive strategies to maximize the utility of their existing resources.

One such strategy is underclocking, a process in which the machines’ electricity consumption is reduced to increase the energy efficiency and reduce costs. This process, which can be facilitated by third-party firmware like LuxOS, significantly improves machine efficiency — a critical adaptation in an environment where margins are thin. The movement towards underclocking is likely to gain momentum.

Moreover, the quest for increased profitability extends beyond operational tweaks to include novel revenue-generating approaches. A compelling example comes from Hashlabs in Finland, where we are undertaking a project taking advantage of several revenue streams to boost mining profitability.

In Finland, we have diversified our income streams to include selling waste heat from our miners to a district heating system, earning fees for contributing to the stabilization of the electric grid, and strategically selling electricity back to the market during periods of high spot prices. These ancillary revenue channels are significantly bolstering the profitability of our mining operation.

The upcoming halving is set to act as a catalyst, driving miners worldwide to emulate Hashlabs by exploring and implementing creative strategies to augment their profits.

Some miners will diversify away from mining

The fierce competitiveness that defines the current state of the mining industry is prompting many, especially public miners, to explore new horizons. Increasingly, there's a move towards AI computing, with companies like Iren and Hive Digital Technologies leading the charge.

The trend towards diversification is expected to pick up momentum over the challenging coming months. Yet, the dynamics of the mining industry are cyclic. Predictions for a bull market in 2025 portend a reversal of this diversification trend. As the value of bitcoin potentially climbs, miners may set aside their diversification strategies in favor of maximizing returns from mining, diving back into the fray with renewed vigor on extracting value from every hash.

This shift between diversification and focused mining reflects the broader ebbs and flows of the market. Miners' strategies evolve with the market, balancing between seizing immediate opportunities in new industries and preparing for the next upsurge in bitcoin mining profitability.

Bitcoin mining will become more geographically decentralized

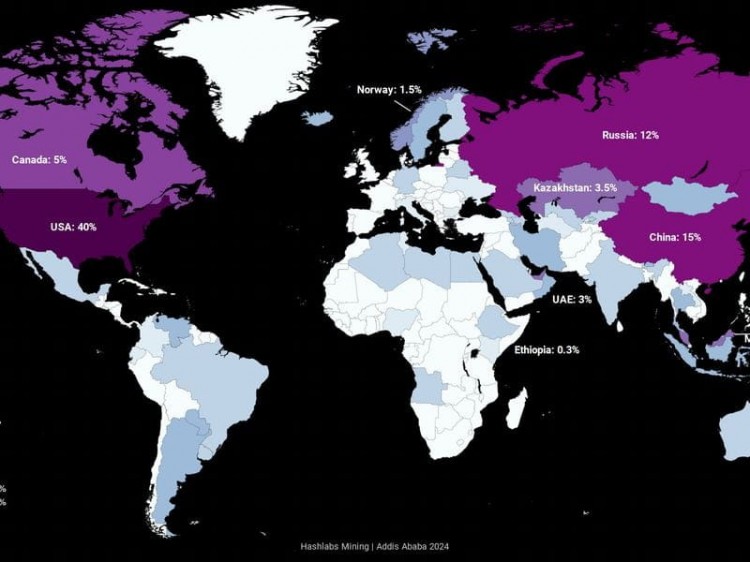

Currently, the United States commands a substantial portion of the global hashrate, accounting for 40%, while China and Russia are also key players, contributing 15% and 20%, respectively. However, the industry is gradually shifting towards a more globally dispersed model, driven by the perpetual quest for cost efficiencies, especially cheaper electricity.

As miners brace for the upcoming halving, many are exploring emerging mining markets across Africa, Latin America, and Asia where electricity is exceptionally cheap. For instance, Bitfarms is making strides in Argentina and Paraguay; Bitdeer is expanding its capacity in Bhutan; Marathon is entering the United Arab Emirates and Paraguay; and Hashlabs is offering hosting solutions in Ethiopia.

The impending halving event acts as a catalyst for hashrate migration, compelling miners to venture beyond developed nations to secure more economical electricity sources. This move towards a more geographically decentralized mining network is poised to have a profound positive impact on Bitcoin. By distributing the hashrate more evenly across the globe, Bitcoin mining will not only become less susceptible to regional regulatory risks and power cost fluctuations but also align more closely with the decentralized ethos that underpins Bitcoin itself.

Little impact on the bitcoin price

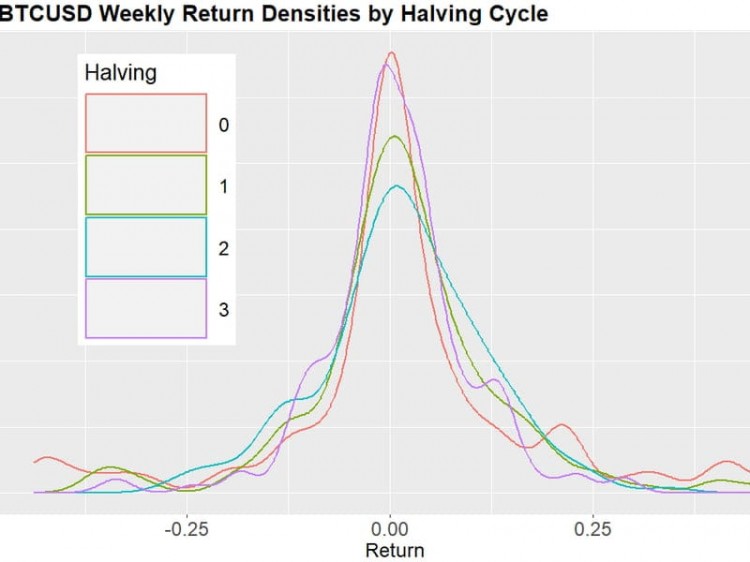

The forthcoming Bitcoin halving is eagerly awaited as a potential trigger for the next bull market. Yet, considering the current annualized issuance rate sits at an already meager level of 1.6%, and with nearly 94% of all Bitcoin already in circulation, the anticipated supply shock from this halving is likely to have a minimal impact on the bitcoin price.

The impact of the negative supply shocks in earlier halvings was profound, especially during the first halving when the annualized issuance plummeted from 25% to 12.5%, and the second when it dropped from 8.4% to 4.2%. However, in this upcoming halving, the decrease from 1.6% to 0.8% represents a much less significant shift compared to the dramatic changes observed in previous cycles.

Don't misunderstand my position; I still foresee a bull market in the wake of this halving. However, the growing demand, and not the meager supply decline, will be the main factor fueling the price surge.

I like Dylan LeClair’s analogy of the halving as a "global advertisement," suggesting that its principal effect on bitcoin's price is not so much the immediate result of decreased supply but rather the increased media attention and investor enthusiasm it generates. This heightened awareness could stimulate demand, turning the halving into a self-fulfilling prophecy of bullish market sentiment.

This perspective also aligns with insights from Daniel Polotsky questioning the continuing relevance of bitcoin's four-year cycle. While fluctuations in demand will persist, the impact of supply changes is becoming increasingly negligible.

At this point, the issuance rate of Bitcoin has become so low that its supply has a minimal effect on its price, which is now primarily influenced by demand. While the narrative surrounding the halving continues to be a strong driver and is expected to propel bitcoin into a new bull market, this influence is likely to diminish in the future. As a result, it's probable that bitcoin will eventually decouple from the four-year halving cycle.

Bring the halving on!

I have great memories from the halving in 2020. The atmosphere within the Bitcoin community was electric with anticipation as we approached the moment when the block subsidy would be cut in half. This pivotal event sparked an incredible wave of bullishness throughout the summer of 2020, setting the stage for the monumental bull market of 2021. Although I remain skeptical that the modest reduction in supply due to this halving will significantly alter bitcoin's price equilibrium, the prospect of it igniting increased demand and investor enthusiasm is something I eagerly await.

From the vantage point of a miner, the halving presents more than just a potential market rally; it's an opportunity to introspect and innovate within our operations. It prompts us to explore new methodologies to reduce costs and enhance efficiency, ensuring our survival and success in this highly competitive field. The halving isn't just a test of resilience but a catalyst for evolution within the mining community.

As we look forward to the next halving, it is essential to remember the core ethos of Bitcoin. Bitcoin wasn't created for the miners; its heart beats for the hodlers. Miners play a crucial role, no doubt, servicing the Bitcoin network and ensuring its robustness. Yet, the true spirit of Bitcoin lies in its ability to empower holders, providing a decentralized alternative to traditional financial systems. The anticipation and excitement for the halving resonate not just among miners but throughout the entire community of Bitcoin enthusiasts and investors.

因此,隨著這一關鍵事件的臨近,讓我們張開雙臂并以創新精神擁抱減半。它提醒人們注意比特幣的動態景觀,證明其彈性,并且是未來令人興奮的發展的燈塔。對于所有持有者和礦工來說,讓我們為減半做好準備。來吧!

![[靜香合約]比特幣減半后,PEPE幣價格會如何變化?會受減半影響嗎?](/img/btc/30.jpeg)