時間:2023-12-18|瀏覽:379

最新的每周收盤價并沒有給緊張的交易者帶來什么安慰,因為“僅上漲”的比特幣價格活動仍在繼續暫停。

距離年度蠟燭結束僅剩兩周時間,風險資產的倒計時已經開始,壓力也隨之而來。

宏觀數據——關鍵的短期波動催化劑—??—將在 12 月剩余時間內持續發布,隨著市場消化美聯儲上周的舉措,美國 GDP 數據也將公布。

目前,比特幣似乎越來越不可能出現“圣誕老人集會”,而且高額費用讓持有者感到苦澀,評論員建議重新關注下個月潛在的現貨 ETF 批準。

潛在的一線希望來自于加密貨幣內外的市場情緒。雖然“貪婪”是景觀的特征,但不可持續的情況卻不見蹤影,隨著“懷疑”的出現,可能為進一步上漲留下空間。

隨著年度 BTC 價格表現的關鍵時刻臨近,Cointelegraph 將更詳細地研究這些因素。

分析師列出了關鍵的比特幣價格支撐位

12 月 17 日周收盤價約為 41,300 美元,當時正值 BTC/美元局部拋售期間。

Cointelegraph Markets Pro 和 TradingView 的數據顯示,隔夜比特幣繼續下跌,比特幣觸及 40,800 美元,然后在亞洲交易時段逆轉回略高于 41,000 美元。

基于最近的比特幣價格走勢,交易員和分析師已經對潛在的進一步下跌保持警惕,因此仍保持謹慎態度。

“圖表不會說謊”,交易資源 Material Indicators 在當天 X(以前稱為 Twitter)上的一篇文章的開頭總結道。

Material Indicators 指出,進入新的一周,比特幣已經失去了 21 天移動平均線——它稱這一事件“本質上是看跌的”。

它補充說,“預計年底獲利回吐和稅收損失收割將在短期內盛行。”

聯合創始人 Keith Alan 繼續表示,爭奪關鍵斐波那契回撤位(相當于 2021 年 11 月的歷史高點)的斗爭仍在繼續。

受歡迎的交易商 Skew 在 4 小時時間范圍內以 200 周期和 300 周期指數移動平均線 (EMA) 以及 50 天 EMA 的形式添加了一些線條——目前均比現貨價格低 2,500 美元左右。

“From here there's two technical levels on 1W/1M,” he continued in commentary on weekly and monthly timeframes.

“$39K - $38K ~ Potential support on HTF, an unsustainable push lower there would be a decent bid. $47K - $48K ~ HTF resistance, unsustainable drive higher higher would be a good area to take profits.”

PCE, GDP due amid increasing belief in Fed “pivot”

The coming week sees the November print of the Personal Consumption Expenditures (PCE) Index — the Fed’s “preferred” inflation gauge — lead U.S. macro events.

Coming after last week’s multiple key Fed decisions, data must now continue to show inflation abating heading into the new year.

The next Federal Open Market Committee (FOMC) meeting to decide changes to interest rates is not until the end of January, but since last week, markets are entertaining the prospect of a “pivot” becoming reality.

The latest data from CME Group’s FedWatch Tool currently puts the odds of a rate cut next meeting at around 10%, with the majority of key macro figures still to come.

“Even with stocks up, uncertainty is still everywhere,” trading resource The Kobeissi Letter concluded in an X post outlining the coming week’s prints.

In addition to PCE, jobless claims and revised Q3 GDP will both hit on Dec. 21.

As Cointelegraph reported, U.S. dollar strength hit multi-month lows around FOMC in a potential fresh tailwind for crypto markets. Those lows have now faded as the U.S. dollar index (DXY) makes a modest comeback, still down around 1.9% in December.

Fees stay elevated

The heated debate over Bitcoin transaction fees has swelled in recent days thanks to these hitting their highest levels since April 2021.

With Ordinals back on the radar, those wishing to transact on-chain faced $40 fees at the weekend, while “OG” commentators argued that the fee market was simply functioning as intended given competition for block space.

Miners, meanwhile, have seen revenues skyrocket as a result — to levels not witnessed since Bitcoin’s $69,000 all-time high.

Into the new week, however, fees have already fallen considerably, with next-block transactions confirming for under $15 at the time of writing.

Commenting on the situation, popular social media personality Fred Krueger argued that market participants should now turn their attention to the decision on the first U.S. spot exchange-traded funds (ETFs) due early next month.

Noting that fees were “already falling fast,” he defended Ordinals’ creators’ right to use the blockchain to store their work.

“This debate looks like a nothingburger for now. Back to waiting for the ETF,” he concluded.

Others, including researcher and software developer Vijay Boyapati, also referenced the transitory nature of the fees debate as it has occurred throughout Bitcoin’s history.

Calling for so-called “Level 2” solutions to speed up development as a result, reactions to the recent elevated fees underscored that off-chain solutions for regular users — specifically the Lightning Network — already exist.

“L1 fees are incredibly high right now. Seems obvious — even if self-serving — that defaulting most transactions to the Lightning Network is the way to go for all exchanges and wallets,” David Marcus, the former Facebook executive now CEO of co-founder of Lightning startup Lightspark, wrote in part of an X post at the weekend.

Per data from monitoring resource Mempool.space, meanwhile, block space remains in huge demand, with the backlog of unconfirmed transactions still circling 300,000.

New addresses pose bull market momentum risk

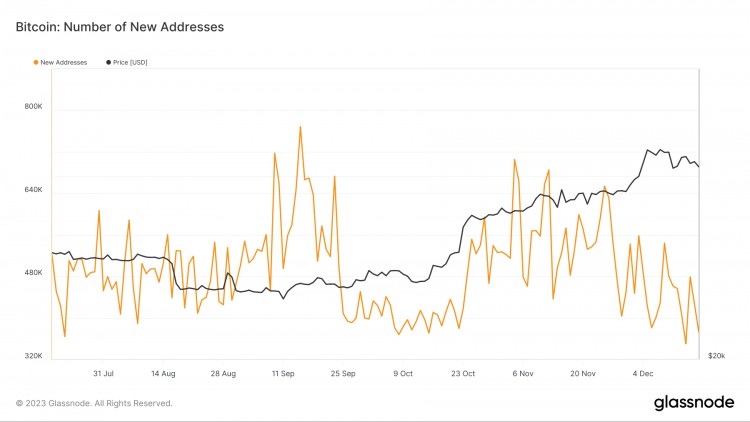

Bitcoin network growth has taken a breather this month — in-line with the bull market comeback.

New data from on-chain analytics firm Glassnode confirms that the number of new BTC addresses has continued its downtrend throughout December.

For Dec. 17, the latest date for which data is available, around 373,000 addresses appeared in an on-chain transaction for the first time. This is approximately half of the recent local daily high, which Glassnode shows came in early November.

Commenting on the numbers, popular social media analyst Ali described the tailing-off of new addresses as “noticeable” and a hurdle to BTC price expansion.

“There's been a noticeable dip in Bitcoin network growth over the past month, casting doubt on the sustainability of $BTC's recent move to $44,000,” he wrote.

“For a robust continuation of the bull rally, it's crucial to see an uptick in the number of new $BTC addresses. This would provide the needed support for sustained bullish momentum.”

Bitcoin new addresses chart. Source: Glassnode

Disbelief behind the fear

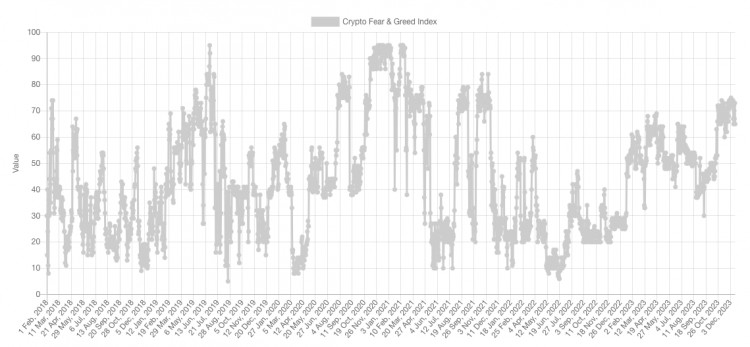

The recent cooling in Bitcoin’s latest “up only” phase has delivered a corresponding pause in market greed.

Related: ‘No excuse’ not to long crypto: Arthur Hayes repeats $1M BTC price bet

According to the latest data from the Crypto Fear & Greed Index, the majority of crypto market participants have been given pause for thought over the past week.

Currently at 65/100, Fear & Greed, which is the go-to sentiment gauge in crypto, still defines the overall mood as “greedy,” but near its least heated in almost a month.

Zooming out, Index scores over 90/100 have corresponded to long-term market tops, as irrational exuberance becomes the average market participant’s mindset. A notable exception, as Cointelegraph reported, was the 2021 $69,000 all-time high, which saw Fear & Greed reach 75/100 before reversing.

Commenting on the current status quo for the traditional market Index, meanwhile, Caleb Franzen, senior analyst at Cubic Analytics, suggested that sentiment was still emerging from the extended Fed tightening cycle that also began in late 2021.

“The Fear & Greed Index is comfortably in the ‘Greed’ range. However, it was just in ‘Fear’ 4 weeks ago and was in ‘Neutral’ to ‘Extreme Fear’ for 2.5 months in September through November,” he told X subscribers on Dec. 14.

“Euphoria? No. This is disbelief.”

![[安迪·沃斯]本質上看跌低于 41,500 美元:本周比特幣需要了解的 5 件事](/img/20231218/2978296-1.jpg)

![[斯凱拉]BTC 價格突破 7 萬美元——本周關于比特幣需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[斯凱拉]BTC 價格突破 7 萬美元——本周關于比特幣需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[泰勒]關于以太坊 Dencun 升級需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]關于以太坊 Dencun 升級需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]關于以太坊 Dencun 升級需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]關于以太坊 Dencun 升級需要了解的 5 件事](/img/20240313/3824780-1.jpg)