時間:2024-04-26|瀏覽:433

“美國恐怖故事”正在上演,經濟增長意外“急轉直下”,而核心通脹卻居高不下。美國“滯脹”風險似乎正在加大,摩根大通首席執行官杰米·戴蒙(Jamie Dimon)表示擔心美國經濟可能重蹈20世紀70年代的覆轍。

對于美國經濟來說,或許比通貨膨脹更可怕的是重返滯脹時代的前景。

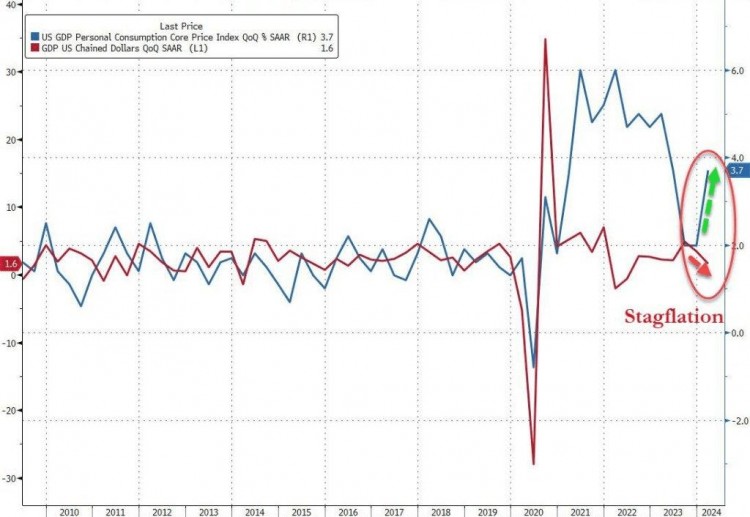

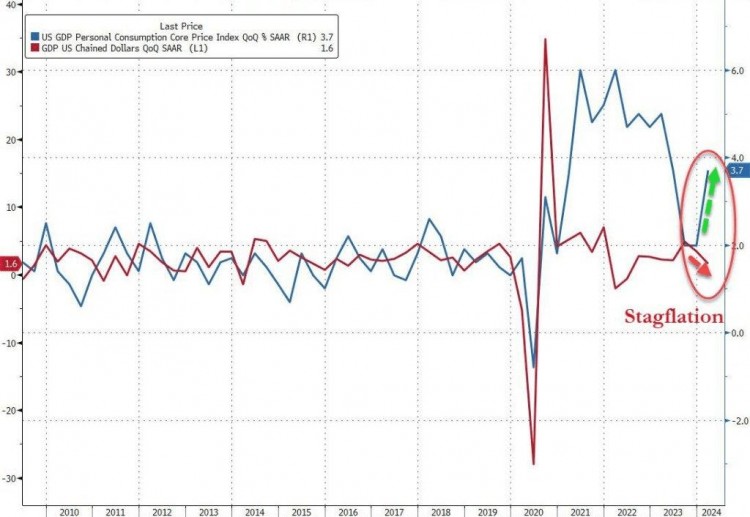

昨天,美國公布了兩個重要經濟數據:一季度GDP和同期核心物價指數。數據顯示,美國一季度國內生產總值(GDP)同比僅增長1.6%,較去年四季度3.4%的增速下滑超50%,創2007年以來最低水平。 2022 年第二季度。

盡管一季度GDP增長“冷淡”,但核心通脹依然出人意料地頑固。美聯儲首選通脹指標核心PCE物價指數一季度意外增長3.7%,創2023年二季度以來新高,高于預期3.4%,較2%增速大幅反彈在第四季度。

一系列數據表明,在通脹居高不下的情況下,經濟增長已開始放緩甚至停滯,暗示美國可能面臨滯脹局面。滯脹被認為是美聯儲面臨的最糟糕的噩夢,甚至比經濟衰退更難應對。

本周早些時候,摩根大通首席執行官杰米·戴蒙指出,盡管美國經濟依然強勁,但可能會出現一段滯脹期。戴蒙擔心美國經濟可能會重蹈1970年代的覆轍,他表示,“是的,我相信這種情況(像1970年代的滯脹)可能會再次發生。現在看來,我們的情況更類似于1970年代。” 1972 年看起來相當樂觀,但 1973 年卻變得很糟糕。”

戴蒙近幾個月頻繁就美國經濟彈性面臨的風險發出警告。正如他在 4 月 8 日致股東的信中表示,這些風險可能導致“比市場預期更頑固的通脹和更高的利率”。

戴蒙警告市場,由于政府支出過多,美國通脹和利率可能仍高于市場預期,他已為美聯儲加息至最高8%做好準備。

However, some views suggest that the emergence of stagflation is still far away. Although inflation has not cooled down, the market still expects at least one interest rate cut this year, and domestic demand in the US remains strong. Pooja Sriram, an analyst at Barclays, pointed out after the GDP report was released that the growth in domestic sales indicates that "demand conditions are still strong," with consumer spending growing steadily by 2.5% and business investment growing faster than expected, mainly dragged down by imports and inventories.

盡管如此,越來越多的經濟學家和策略師都認為對“金發姑娘”的信心正被數據逐步粉碎,Glenmed投資策略副總裁Mike Reynolds直言,盡管“金發姑娘”的說法今年以來一直占據市場經濟敘事的主導地位,但從多方面來看,這個“姑娘”似乎被GDP報告絆了一跤,擦破了膝蓋。

Nevertheless, an increasing number of economists and strategists believe that confidence in the "Goldilocks" scenario is gradually being eroded by data. Mike Reynolds, Vice President of Investment Strategy at Glenmed, bluntly stated that despite the "Goldilocks" narrative dominating market narratives this year, it seems that this "girl" has stumbled over the GDP report and scraped her knee from various perspectives.

美國當前狀況與70年代的驚人相似性

The Striking Similarities between the Current Situation in the US and the 1970s

上世紀70年代,美國曾一度陷入“大滯脹”的泥潭,越南和中東沖突導致美國面臨能源危機、航運中斷和赤字支出激增等問題,1973年和1979年兩次石油危機導致能源價格飆升,高昂的能源價格引發美國通脹率飆升,1980年曾一度達到13.5%的高位水平,同時伴隨著高失業率和經濟增長乏力。

In the 1970s, the United States fell into the mire of "grand stagflation," facing issues such as energy crises, shipping disruptions, and surging deficit spending due to conflicts in Vietnam and the Middle East. The oil crises in 1973 and 1979 led

After the data was released, US Treasury yields and inflation-adjusted yields both rose to their highest levels since November last year. Markets now expect the probability of the Fed raising interest rates before December to rise from 17% a day ago to 21.4%.

Fitch Ratings economist Olu Sonola wrote that the focus of the current US economy is the soaring inflation. If economic growth continues to decline slowly, but inflation surges again in the wrong direction, expectations for the Fed to cut interest rates in 2024 will further decline.

Nick Timiraos, a well-known financial journalist known as the "new Fed correspondent," wrote that the US economic activity report released on Thursday brought the latest bad news to investors and Fed policymakers. They had hoped that the slowdown in economic growth and cooling inflation would allow the Fed to start cutting interest rates this summer, but in fact, the opposite is true.

Timiraos指出,最新數據表明,經過去年下半年的完美降溫后,美國通脹已被證明比預期更為頑固。數據顯示,今日公布的3月核心PCE物價指數同比增速或將高于0.22%,接近0.3%(市場普遍預期的水平)。這意味著通脹壓力可能比此前預期更大。 1 月和 2 月的核心 PCE 數據也可能向上修正。

應該指出的是,滯脹是每一位央行行長最可怕的噩夢。為了解決20世紀70年代的滯脹問題,美聯儲更換了兩位美聯儲主席,但未能根治。 1979年,保羅·沃爾克大幅提高利率,聯邦基金利率最高達到20%左右。盡管這一措施最終控制了通貨膨脹,但也導致了1980年至1982年的經濟衰退,失業率超過10%。