時間:2024-03-11|瀏覽:353

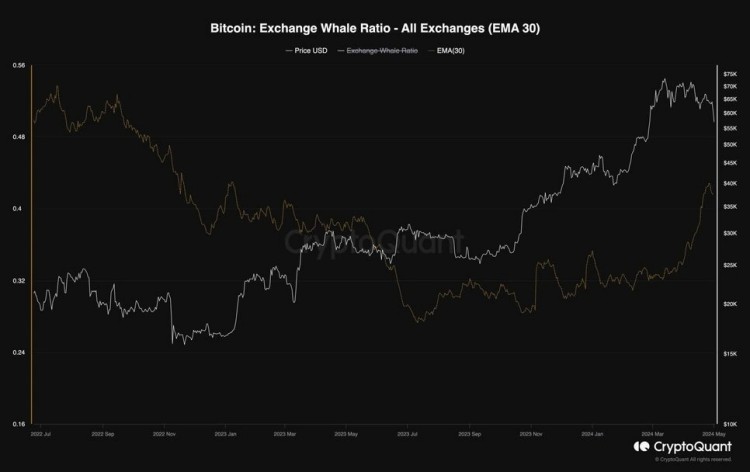

昨天比特幣的暴跌似乎部分是由鯨魚在 2010 年通過挖礦直接積累加密貨幣的大筆拋售引發(fā)的。

該神秘實體在交易時段總共出售了 1000 BTC,該神秘實體此前曾在過去幾年中清算過另一筆開采供應(yīng),當(dāng)時區(qū)塊獎勵較高且市場競爭很少。

具體來說,讓我們看看這些銷售對比特幣價格產(chǎn)生的真正影響是什么,以及鯨魚是否仍然有資源可以貨幣化。

比特幣價格走勢:昨天的暴跌是由 2010 年開采 BTC 的鯨魚造成的

昨天,當(dāng)比特幣在經(jīng)歷一系列積極蠟燭之后即將經(jīng)歷第一次大跌時, 2010 年開采過這種加密貨幣的鯨魚決定按下賣出按鈕 ,加劇了跌勢。

據(jù) btcparser.com 網(wǎng)站稱,這位 BTC 大戶在 833,219 區(qū)塊內(nèi)的多筆交易中,總共將 1000 BTC 轉(zhuǎn)移到 Coinbase,價值約 6329 萬美元 。

總體而言,這些到交易所的轉(zhuǎn)賬源自 20 個不同的 Pay-to-Public-Key-Hash (P2PKH) 地址,每個地址包含 50 個比特幣(2010 年的原始區(qū)塊獎勵),然后合并為一個 Pay-to-Script-Hash( P2SH)地址,在區(qū)塊瀏覽器上公開顯示為“36i1W”。

同樣的代幣最初是在 2010 年 8 月、9 月、10 月和 11 月開采的,當(dāng)時該貨幣的交易價格為 0.39 美元,昨天的交易日以歷史最高價出售。

沒有人知道誰隱藏在礦工的加密身份背后:最可怕的是,在 比特幣大轉(zhuǎn)儲到來之前,這個人設(shè)法清算了他們的硬幣儲備。

與許多人認(rèn)為的相反,這頭鯨魚并沒有閑置 14 年,而是已經(jīng)轉(zhuǎn)移了幾枚代幣以賺取一些利潤。

事實上,提取第一批比特幣的同一地址還 負(fù)責(zé)另外 16 筆交易,其中總共轉(zhuǎn)移了 17,000 BTC。

第一次轉(zhuǎn)賬可以追溯到 2020 年 3 月 11 日,正好是在 covid-19 到來導(dǎo)致恐慌蔓延期間,比特幣暴跌 40% 的前一天。

3月份之后,同年10月份進(jìn)行了第二次調(diào)查,隨后幾個月進(jìn)行了其他交易。

鯨魚在 2021 年恢復(fù)活動,這次比特幣 ATH 也達(dá)到了 69,000 美元,之后是熊市典型的長期拋售階段

從那時起,這個話題就沉寂了兩年,直到 2023 年 12 月才重新出現(xiàn),最后就在幾天前。

It is very curious that the movements of the entity correspond to very important moments for the price action of the asset, precursors of trend reversals in the medium term, and sometimes coincide with historical dates on the bitcoin calendar, as happened on the date of its anniversary on January 3, 2021.

According to some estimates (not currently verified), the whale still owns several coins, ready to be moved at the most opportune moment.

Volumes of exchange significantly higher than the entity’s sales

At this point we move on to observe what were actually the “damages” caused to the price of Bitcoin by the sales of the alleged whale just before yesterday’s dump.

Many users on X seem convinced that the profit taking by this entity was the move that caused the crash, leading to liquidations of over 1 billion dollars of futures positions in the market.

However, in reality, observing what are simply the data of the volumes on the main cryptographic exchange markets, we notice that the impact of a 1000 BTC sell should be minimal on the price of the asset.

For example, on Coinbase yesterday a total of 65,575 BTC were traded (only on the BTC-USD trading pair) for a total value of over 4.3 billion dollars.

Even assuming that all the quota transferred by the whale has been liquidated instantly (we can only guess, but not empirically prove), it would represent just 1.52% of the spot volumes recorded on Coinbase, all without considering the other trading pairs of the exchange, the other spot markets, the futures markets, and the multi-billion dollar exchanges happening on Wall Street through the new ETFs.

In this regard, the latter seem to be the real catalysts of new impulses, in pump or on dump, given the large amounts of capital moved during trading sessions in funds managed by BlackRock, Grayscale, Fidelity, Bitwise etc.

Yesterday, trading on bitcoin ETFs reached a record volume of $9.58 billion, approximately 150 times the value sold yesterday by the whale at all-time highs.

ULTIME NOTIZIE: Il #volume di scambi degli #ETF su #Bitcoin spot ieri ha superato i i 9,58 miliardi di dollari, stabilendo un nuovo record:BlackRock: $3.703.236.139Grayscale: $2.794.038.139Fidelity: $2.028.277.875ARK Invest: $483.929.681Bitwise: $294.442.475Invesco:…

At most, we can throw a stone in favor of those who think that the transfer of 1000 BTC was still an event to be taken into consideration, if we hypothesize that this may have pushed other large whales to switch to sales.

Following the flow of capital managed by those in the crypto world for many more years than us could indeed have been the strategy of several operators, who, noticing the liquidations by the dormant address, also decided to sell their own stocks.

然而,由于我們無法驗證這種假設(shè)的相關(guān)性,因此我們只是將這種規(guī)模的交易描述為“無關(guān)緊要”,因為它們不能單獨導(dǎo)致我們昨天目睹的拋售程度。