區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析

區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析時(shí)間:2024-03-08|瀏覽:359

Original author: @DL_W59

Original source: X

Note: The original text comes from a long tweet posted by @DL_W59.

How to make money from trends? Explain the relationship between the changes in long-term#btcholders and the explosion of altcoins.

The so-called trend money, such as BTC from 10,776 to 69,000 in the 20-21 period, the trend of altcoins is profitable. There are hundreds of times, dozens of times, and the worst is three to five times.

Now, the previous#btcis up to 69000. Friends must be complaining, tmd, why don’t copycats rise? The meme sector has finally taken off. Is there a big explosion coming? Before answering this question, let’s look at the data of the previous period.

In October 2020, Bitcoin started its main rise from 10776. On November 25, it touched the 17-year high of 19484 for the first time, ushering in a correction. Then in December, it completely broke through the 17-year historical high and ushered in a substantial pullback. rose until the correction in January 2021. It started to rise again in February.

At this time, look at all coins except#btc(including eth here). It just happened that the outbreak started in January or February of 2021, which is very typical.

For example, the platform currency bnb is in February, the game leader AXS is in January, the L1 sectors sol, avax, and matic are in January, the meme leaders doge and shib are in January, the metaverse boss sand is in January, and the dex platform currency uni is in January. Wait, there's eth here. Although eth rose in November and December, the sharp rise was also in January. I won’t give examples of the others one by one. Friends can explore on their own.

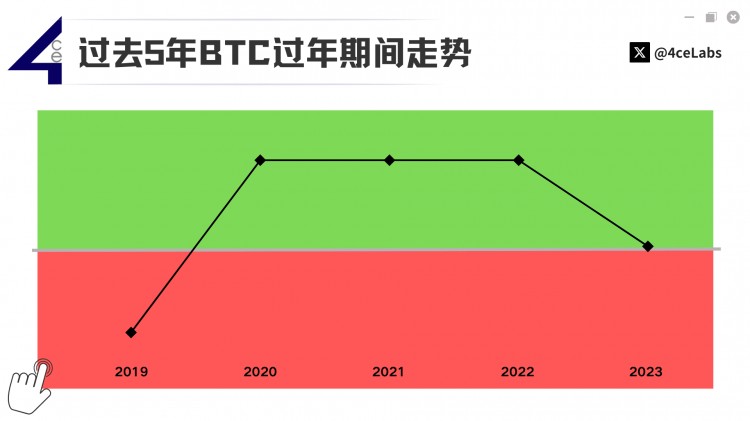

As mentioned before, the outbreak of copycats was in January, right? Let’s take a look at the data chart of long-term BTC holders as follows.

(The upper curve is the Bitcoin price, and the lower curve is the change in the number of Bitcoin positions held by long-term holders)

It is obvious that by January 1, 2021, the number of BTC positions held by long-term holders was being sold significantly. To put it bluntly, Bitcoin overflow funds came out. Until long-term holders' selling slowed down or even stopped selling. Then the price of Bitcoin increased even more, from more than 40,000 in February to more than 60,000 in May, and then the copycat I mentioned earlier. I don’t need to say more about the trends from February to May.

Look at now. You can think that it is very similar to the first time it hit the high of 69,000 on November 25, 2020. But what we have seen is that the meme sector in the copycat market has risen sharply, and there have also been a few pullbacks in other areas. However, most of the copycat sectors did not explode together. Why, the overflow funds are too small. And the price has not stabilized at its previous high. It can also be seen from the trend of the curve on the right side of the picture that long-term holders have only just sold their BTC to a certain extent, and there is still a lot left.

Seeing some friends here, I’m wondering if something big is coming. Now I’m looking for low-market copycats on popular tracks to ambush, waiting to take off.

This requires#btcto stabilize at least 69,000 and above this month, and then in April, May, or even June, it will quickly achieve a large increase to 80,000, 90,000 or even higher, and long-term holders will ship in large quantities. . can be achieved.

So combined with all the current situation mentioned in the tweet I mentioned earlier, including macro, fundamentals, on-chain data, and news. Do you think Bitcoin can be realized in the next three months?

Even if it can really be realized, there will be enough time to ambush you. Remember what I mentioned earlier, from breaking through 19,000 in December 2020 to 40,000 in January 2021, the copycat only broke out in January. So there is plenty of time. Now everyone can observe, is there a trend? Are there any good copycats that we can pay attention to? In addition to the existing ones, we adhere to the principle of speculating on the new rather than speculating on the old. Is there anything new that the second-level graduates of major law schools should pay attention to?

If BTC cannot be realized in the short term of three months, then there will be more time.

So, now, I know everyone is excited to see 69,000 BTC, but please don't be excited yet; seeing the meme section, especially pepe, is ten times more, it's very FOMO, but please don't FOMO, where is this?

Don’t lose your principal at this time. The big one hasn't come yet. Several times, dozens of times, hundreds of times are waiting for you to eat. That’s trend money. One of the channels through which ordinary retail investors can achieve rapid wealth growth.

This is not investment advice, please invest rationally. In 2024-2025, I wish you all the best A11. Thanks