時間:2024-02-18|瀏覽:397

近日,華爾街明星基金經理、方舟投資管理公司首席執行官、被譽為華爾街科技股女神的凱西·伍德帶領方舟投資公司研究團隊發布了一份長達163頁的報告。 在題為《Big Ideas 2024》的研究報告中,穆穆女士及其團隊公開表示,他們認為比特幣銘文是比特幣健康創新的代表。

作為資深華爾街明星基金經理,Kathy Wood 對比特幣 Inscription 的認可或許預示著 Inscription 板塊未來有望迎來第三輪熱潮。

比特幣銘文的興起源于兩個關鍵的比特幣鏈上社會實驗。

2022 年 12 月,比特幣核心開發者 Casey Rodarmor 發起了一項名為 Ordinals 協議的社會實驗,該協議使得比特幣區塊鏈上的每個最小單位 Satoshi 都能夠被唯一標記和排序。 此外,它還允許用戶將任意數據(包括文本、圖像、音頻、視頻等)寫入每個中本聰中,這些數據(俗稱銘文)可以與比特幣一起永久存儲。

隨后,2023年3月,匿名用戶domodata發起了另一項社會實驗——BRC20協議。 BRC20在Ordinals協議的基礎上,進一步定義了銘記數據的格式,規范了銘記數據的部署、鑄造和傳輸方式,從而在比特幣鏈上引入了類似于以太坊ERC20協議的同質代幣資產。 發布標準。

這兩個協議共同構成了銘文軌道的基石。 特別是,BRC20協議采用的“先到先得”的鑄造模式確保所有用戶,無論身份或資金數額如何,在鑄造BRC20銘文代幣時都處于平等的起點。 這種鑄造方法被廣泛認為是一種獲得碎片的更公平的方式,通常被稱為“公平鑄幣”。

正是這種技術上保證的公平性,使得比特幣鏈上發行的銘文,尤其是通過BRC20協議發行的銘文代幣,受到幣圈散戶投資者的熱烈歡迎。

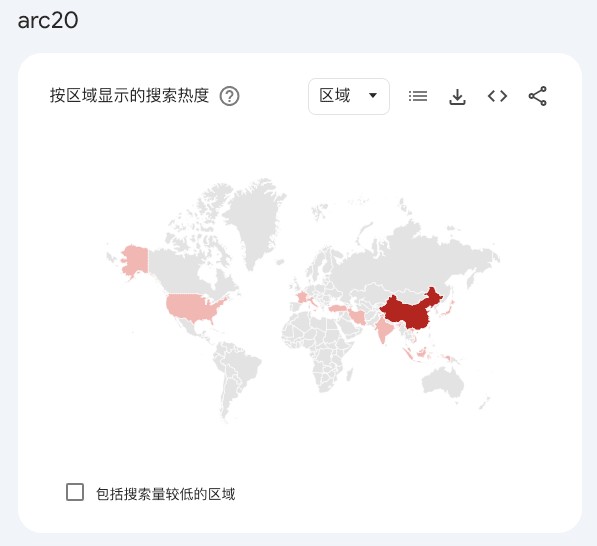

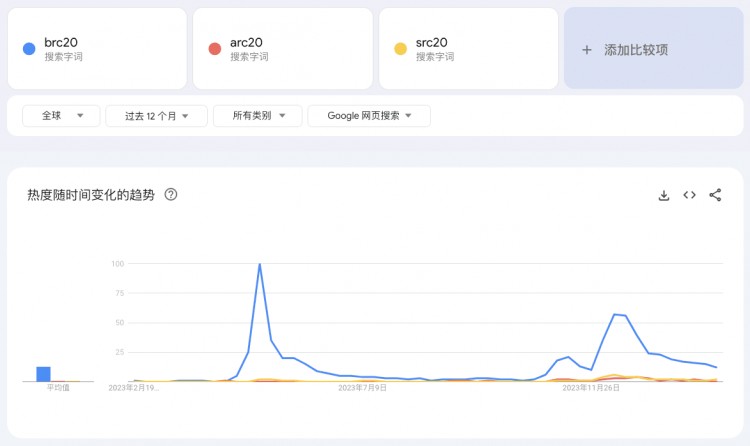

從圖1的Google Trends我們知道,近一年來BRC20、ARC20、SRC20的搜索熱度趨勢表明,比特幣銘文的受眾主要集中在華人社區,而參與的有歐洲、美洲和其他亞洲地區。國家低。

圖1、數據來源:https://trends.google.com/trends/

綜合考慮多方面因素,除了銘文協議從技術層面保證了芯片的公平獲取并因此受到幣圈散戶投資者的廣泛歡迎外,還有幾個重要原因:

Chinese-dominated Bitcoin mining pools give strong support to Inscription

Since 2012, China has become the main computing power provider for global mining. Even when Vitalik, the founder of Ethereum, was raising funds for the Ethereum ICO, he saw that China accounted for more than half of the global Bitcoin mining computing power. , chose China as the first stop for its ICO fund-raising.

The early global mining pool computing power ranking is shown in Figure 2.

Figure 2, data source: https://webcdn.qkl123.com/ranking/pool

However, in 2021, the Chinese government introduced a policy banning cryptocurrency mining, coupled with the intensified competition among mining pools and the rapid upgrading of mining equipment, leading to the closure of some mining pools. Although China's mining computing power has declined as a result, the computing power of Chinese mining pools still occupies a major position in the global mining computing power.

According to the latest year’s mining pool computing power data, four of the top ten mining pools in the world are still from China.

Figure 3, data source: https://mempool.space/zh/graphs/mining/pools#1y

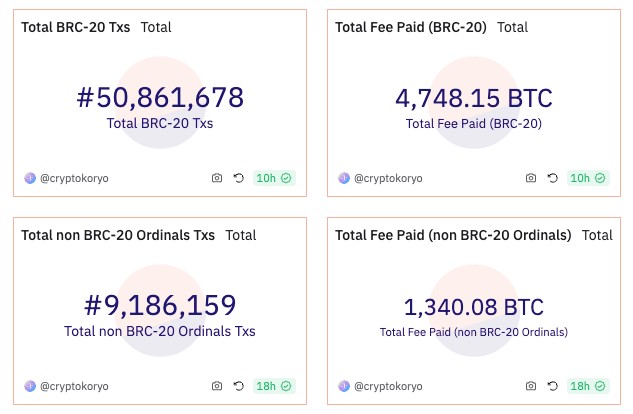

Therefore, the birth of Inscription has opened up another source of income for Bitcoin miners. According to the dune data in Figure 4, the Ordinals protocol and the BRC20 protocol, the main popular protocols of Bitcoin Inscription, have brought more than 6,000 Bitcoins to Bitcoin miners in the past. fee income. This sustainable revenue stream will bring more benefits to Bitcoin miners after the Bitcoin mining reward is halved in April 2024.

Figure 4, data source: https://dune.com/cryptokoryo/BRC20

Therefore, considering the important role of inscriptions on miners, Chinese mining pools also strongly supported the development of Bitcoin inscriptions at the first time. As shown in Figure 5, Shenyu, the founder of the world’s third largest mining pool, stated on Twitter that he began exploring inscriptions in February 2023.

Figure 5, source: https://twitter.com/bitfish1/status/1740597261011386430

Top exchanges led by Chinese actively promote the development of Inscription

Nearly half of the most popular centralized exchanges were founded by Chinese. And more than half of the top 10 exchanges have launched the Inscription trading market, showing their strong support for Inscription.

In particular, Gate.io and Huobi Exchange have announced support for the launch of Inscription in May 2023, further proving the positive attitude of mainstream exchanges towards Inscription.

Figure 6, source: https://coinmarketcap.com/zh/rankings/exchanges/

Therefore, driven by the joint efforts of Chinese-dominated mainstream exchanges, miners, and retail investors, the Bitcoin inscription craze first broke out in areas where Chinese are the majority, such as China.

According to data from Google Trends, following the second wave of inscription craze from November to December 2023, the popularity of Bitcoin inscriptions has shown a gradual downward trend.

Figure 7, data source: https://trends.google.com/trends/

As major exchanges announced the launch of the Inscription trading market, especially on February 1, 2024, the Web3 wallet of Binance, the world's largest encryption centralized exchange, officially launched the Inscription trading market. So far, several companies except coinbase have launched the Inscription trading market. Major centralized exchanges have launched the Inscription trading market to support the development of Inscription.

And recently, Kathy Wood, known as the goddess of Wall Street technology stocks, also publicly recognized the Bitcoin inscription (Figure 8), saying, “In our view, this is the product of the free market and represents the healthy innovation of Bitcoin. ".

Figure 8, source: https://assets.arkinvest.com/

This recognition from Wall Street star fund managers is expected to drive overseas markets to further increase their attention to the inscription track, thus igniting the third wave of Bitcoin inscription craze. And with the joint efforts of users at home and abroad, we have reason to expect that the third round of inscription boom will show stronger vitality.

As the first homogeneous inscription token protocol on the Bitcoin chain, the BRC20 protocol is far more popular than other improved protocols. Inscriptions Ordi and sats issued through BRC20 are the only inscriptions listed in the spot area of ??mainstream centralized exchanges. token, bringing a lot of attention and traffic to BRC20 inscription. Therefore, in the next round of inscription craze, the BRC20 protocol is also expected to be the first to be empowered by support from multiple parties at home and abroad.

OrdiOverview

Ordi is the first inscription issued through the BRC20 protocol, marking its important position on the inscription track. Its name comes from the first four letters of the Ordinals protocol, a clever naming that gives it unique narrative value.

Release information

Ordi was created in March 2023, with a total circulation set at 21 million coins, an amount identical to the total supply of Bitcoin, further reinforcing its special identity and value as an inscription.

market performance

Since its birth, Ordi has created returns of ten thousand times, demonstrating its huge potential as an investment target. This astonishing growth has attracted widespread attention and helped it land on multiple mainstream exchanges, including Binance, Oyi, Huobi, etc.

The latest data

As of February 17, 2024, Ordi's market capitalization was approximately US$1.47 billion, ranking it 55th in the global market capitalization rankings. In addition, the number of its currency-holding addresses is approximately 16,000, a number that reflects Ordi’s popularity and broad acceptance among investors.

Ordi's potential assessment

Ordi's potential assessment can be analyzed from two different perspectives, reflecting its growth potential in the future market.

Evaluation as a Meme Coin

Considering that the current market values ??of Longyi Doge and Longer Shib in the meme currency sector are approximately US$12.1 billion and US$5.7 billion respectively, we can extract a rough expectation of Ordi's future growth potential from these data.

As an emerging meme currency, Ordi is estimated based on the leading market value of the meme sector. It is expected that Ordi will have room for growth of 4 to 10 times in the future.

Assessment as a new narrative leader for asset issuance

Another evaluation logic considers Ordi as the leader of the new narrative of asset issuance. Generally, the leading token of the new narrative has the opportunity to enter the top 20 of the crypto market.

Based on the current market value of Litecoin (LTC), which is ranked 20th, at approximately US$5.2 billion, it is estimated that Ordi will have room for growth of 3 to 4 times in the future.

Comprehensive Evaluation

Considering the multiple narrative blessings behind Ordi - including being the leader of a new narrative for assets, the engine of the next bull market, and the empowerment of the Bitcoin ecosystem, Ordi shows great growth potential as an investment target. Whether assessed from a meme coin perspective or a new narrative leader perspective, Ordi shows the potential for significant growth in the future market.

Introduction to Sats

Sats represents the abbreviation of Satoshi, which is not only the smallest unit of Bitcoin, but also pays tribute to Satoshi Nakamoto, the founder of Bitcoin, as its narrative core. The naming of Sats and the story behind it show respect for Bitcoin and its founder.

Release details

Sats was created in March 2023, and the total issuance is set at 2,100 trillion. This number symbolizes an extension and tribute to the supply of Bitcoin. The casting process of Sats took 6 months and went through 21 million casting operations. This complicated process has accumulated a strong community consensus for Sats.

Practical application

In the early days of the minting of Sats, the unisat decentralized exchange formed a plan to mint Sats as a unisat point. Subsequently, unisat launched BRC20-swap, a function that supports BRC20 protocol token exchange, and used Sats as transaction fees, which provided practical application scenarios for Sats.

market performance

Sats has also successfully landed on multiple mainstream centralized exchanges including Binance, Ethereum, etc., showing its popularity and recognition in the cryptocurrency market.

The latest data

As of February 17, 2024, Sats' market capitalization was approximately US$1.105 billion, ranking it 72nd in the global market capitalization rankings. The number of currency holding addresses reached approximately 46,100.

Market potential assessment of Sats

Sats, as an inscription paying tribute to Bitcoin founder Satoshi Nakamoto, comes with a strong narrative and a deep community foundation. Coupled with its potential influence in the Bitcoin ecosystem, Sats has shown considerable growth potential. However, in terms of narrative strength, Sats may be slightly inferior to Ordi - the latter has a unique identity as the first inscription issued through the BRC20 protocol.

Market value estimation logic

Although Sats may not be as strong as Ordi in terms of narrative, the community support behind it and the blessing of the Bitcoin ecosystem still provide the basis for its future market value growth. Considering the comparison of the market values ??of Long Yi Long Er Doge and Shib in the meme currency sector, we can roughly estimate that the market value of Sats is expected to reach more than half of Ordi's market value in the future. Although Sats may briefly exceed Ordi's market capitalization at certain moments, it is likely to remain at a relatively low level most of the time.

in conclusion

Based on the above analysis, although Sats may not be as good as Ordi in terms of narrative, its good community construction and potential support from the Bitcoin ecosystem mean that it still has certain growth potential in the future. Therefore, investors can look forward to how Sats will perform in the market in the future.

Introduction to Piin

Piin was created in November 2023. It uses the desire of the people at the bottom to stand up and release the consensus potential of the 50 million miners in the pi network community as its narrative, highlighting its unique position and goals in the crypto community.

Piin is spontaneously initiated by pi network community users, so Piin can also be expressed as pi inscription, which is the inscription of 50 million pi community users.

In addition, Piin’s animal image is an eagle, which symbolizes freedom and vision, bringing new vitality to the meme currency market.

Release and Distribution

The total circulation is 100 billion, and the chip distribution is more dispersed than the previous three inscriptions, showing its inheritance of the fairness of the BRC20 protocol and the decentralized spirit of Bitcoin.

As of now, Piin’s market value is approximately US$15 million, and the number of currency-holding addresses is approximately 8,200.

Community Consensus and Growth

Piin minting requires a total of 100,000 operations, but users completed all minting operations in just one day, and achieved an increase of 8,000 currency-holding addresses in just 2 and a half months, with an average daily increase of more than 100 addresses. The growth rate of addresses far exceeds that of Ordi, sats and other inscriptions issued at the same time.

And according to Ouyi Web3 wallet market data, Piin ranks fourth in total transaction volume among BRC20 inscriptions, second only to Sats, Rats and mice. This achievement also proves its strong community consensus and market acceptance.

Community culture and volunteer groups

Various community volunteer groups such as foundation, publicity group, design group, and order-making group have been formed in the Piin community, which reflects its good community construction and high degree of participation of its members.

In order to allow more people to join Piin easily, a unique pin-up culture has spontaneously formed in the community, making it easier and freer to purchase Piin inscriptions. Through this unique pin-up culture, all inscriptions are following The Bitcoin ETF passed through the pullback wave caused by keeping Piin sideways at lower prices for more than 2 months.

Exchange situation

Although Piin has not yet been listed on the spot section of any centralized exchange, its performance in decentralized markets and Web3 wallets on centralized exchanges has shown great potential and market recognition. Piin’s community activity and market performance indicate that its liquidity and market influence will be further enhanced once it is listed on the exchange.

Piin market potential and valuation outlook

narrative potential

From a narrative perspective, the core of Piin Inscription is to unleash the consensus potential of Pi Network’s 50 million miners and help the underlying public turn around.

The Pi Network community has users all over the world. According to the latest data, there are approximately 30 million active users in China and 20 million active users overseas. This means that Piin has a greater international advantage than other inscription projects. With a huge base of 50 million potential users, Piin is expected to achieve rapid exit.

In addition, multiple Pi Network official Twitter accounts with millions of overseas fans are also constantly providing endorsement and publicity support for Piin (Figure 8). Coupled with the recent recognition of Bitcoin Inscription by Wall Street, Piin is expected to be able to attract more overseas traffic, enhancing its appeal and influence around the world.

Figure 9, source: https://twitter.com/lyws0223/status/1748359074964783196

Market value comparison and growth space

Currently, Piin's market value is only 1/100 of Ordi's market value, which to some extent underestimates the 50 million out-of-circle consensus potential behind it and the community's ability to continue to grow.

Comparing the current meme currency giants on the market - doge has about 5.73 million currency holding addresses, shib has about 1.34 million currency holding addresses, and Piin has 50 million potential supporters. Its narrative and community building The depth and breadth provide great imagination and growth potential.

Potential

Although Piin has not yet been listed on any centralized exchange, its growing number of currency holding addresses and steadily rising transaction volume have proven the market's high expectations and recognition of it. The exchange is an important growth point for any crypto asset and can significantly increase its liquidity, visibility and acceptability. For Piin, once it successfully lands on mainstream exchanges, it will undoubtedly bring unprecedented traffic and attention to it, thereby further promoting market value growth.

With the strong support of mainstream exchanges, miners, and retail investors, Bitcoin Inscription has experienced two rounds of craze.

With the endorsement of Binance, top Wall Street fund managers, the approval of Bitcoin ETF, and the approaching Bitcoin halving event, we have every reason to believe that Bitcoin Inscription will usher in its third wave of craze.

In addition, thanks to the joint promotion of domestic and foreign users, the third round of craze is expected to surpass the previous two in terms of scale and influence.

Therefore, we should continue to pay attention to the development of Bitcoin Inscription and look forward to its future performance.