時間:2024-02-07|瀏覽:375

撰文:深潮TechFlow

每一個周期,都有屬于那個周期的英雄。

本著“炒新不炒舊”和“喜新厭舊”的渣男本色,我們關注那些即將在2024年推出的新項目,或者說“大項目”;篩選標準十分優越,核心圍繞著新的敘述和展開,比如AI、硬件EVM、DePIN、比特幣生態、分級區塊鏈,其中大部分仍然是基礎設施,在我們看來,基礎設施記錄空間更大,而且較難證明偽。

注:本文分為上下兩部分,篩選標準十分優越,并且以尚未發行的代幣的全新項目為主。

Monad: 毛EVM 敘述領跑者

談到EVM這個敘述,必然提到了Monad。

Monad 是一個專注于提高 EVM 性能的創新項目,通過毛發處理技術,旨在解決現有區塊鏈網絡的性能瓶頸。

填充EVM是對傳統EVM的一種創新優化,傳統EVM下,負責按順序處理智能合約和交易,在高負載情況下會導致效率低下和網路堵塞,填充EVM的核心思想是改變這種串行處理模式,實現多個交易的同時處理。

通過實現全部執行,Monad的目標是大幅提升交易吞吐量,解決現有EVM鏈在高負載下的擁堵問題,其最終目標是達到物理帶寬限制的400,000 TPS。

在實現上,Monad 的時鐘執行策略核心提供了它能夠識別和通過執行沒有共同依賴的交易。雖然 Monad 和以太坊的區塊都是線性小區的交易集合,但 Monad 優化執行策略允許事務在不影響最終結果的情況下工具進行,其功能體現在:

2024年,Monad將成為L1戰場不容忽視的大玩家。

2023年2月14日,Monad完成了由Dragonfly Capital領投的1900萬美元種子輪融資。

官網:https://www.monad.xyz/

推特:https://twitter.com/monad_xyz

更多資料請查看我們之前的研究和創始人專訪:

《提前布局下一個記述:大量EVM興起,哪些項目值得重點關注?》

《對話Monad Labs CEO:從傳統到未來,原Jump Trading團隊探索公鏈在鏈上金融的角色》

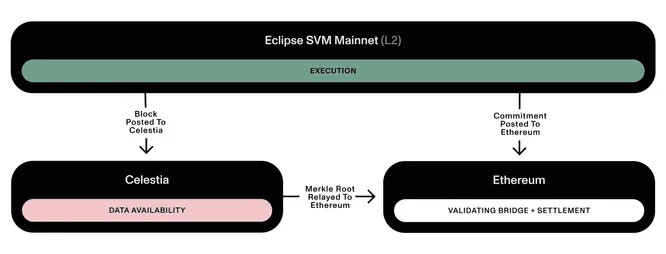

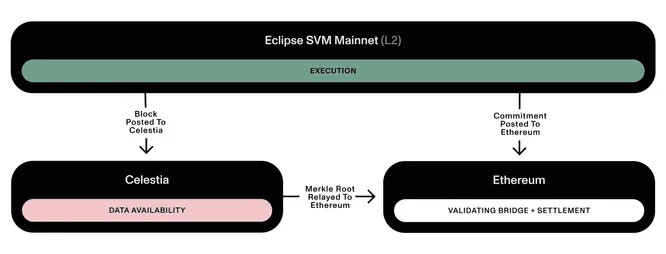

Eclipse:Solana 虛擬機(SVM)L2

Eclipse是以太坊的Layer2,可利用Solana虛擬機(SVM)加速交易處理。

項目目標是提供一個大規模批量執行的環境,允許多個操作同時進行,從而提高網絡吞吐量和效率,同時減少擁堵和交易費用。通過這種結構,Eclipse旨在提高 dApp 的可擴展性和用戶數體驗。

2022年9月27日,Eclipse完成900萬美元種子輪融資,由Tribe Capital和Tabiya共同領投。

官網:https://www.eclipse.builders/

推特:https://twitter.com/EclipseFND

EigenLayer:以太坊坊

EigenLayer是以太坊區塊鏈上的一個創新協議,它引入了“重新質押”(restake)的概念,允許用戶利用其已固定的以太坊或坊Liquid Stake幣代獲得額外的獎勵和安全貢獻。

另一方面,Eigenlayer釋放了抵押的ETH的資本效率,在繼承了以太坊安全性的前提下,以太坊各應用領域的創新速度大幅度提高,且驗證成本迅速下降,ETH成為了能夠創造高收益的生產性資產。

另一方面,Eigenlayer不僅僅是重新奪取,其重新構建了多人以太坊基礎基礎建設。

相當于Eigenlayer的旗艦產品之一就是其數據模塊可用性,即EigenDA(Eigen Data Availability),與Celestia相比,EigenDA有一個明顯的優勢——它能夠通過利用現有的ETH驗證器和質押更輕松地引導大型驗證器網絡,成本會更大,吞吐量會更大。

例如,Mantle Network 是第一個使用 EigenDA 的 Layer 2。

另外,也可以在Eigenlayer上運行去中心化Rollup排序器,改變目前大部分L2都是中心化排序的索引。另外,Eigenlayer將實現真正的中心化RPC節點。

近期,Eigenlayer將其觸角伸向了Cosmos生態,Eigenlayer高調宣布能夠為Cosmos子鏈提供以太坊的安全性保證。

根據官網的最新數據,Eigenlayer目前有超過65個生態項目。

For example, AltLayer, which was recently launched on Binance, is also an Eigenlayer ecological project. In the early days, AltLayer focused on the Raas concept of sending links with one click. Later, it focused on promoting Restaked Rollups created in cooperation with Eigenlayer. This concept is relatively abstract. Let’s explain it in a layman’s terms:

For most other projects, if you want to build an application chain, the best situation may be like this:

I don’t have to worry about how to make a Rollup from beginning to end, nor do I need to worry about how to ensure the security of the chain after doing the Rollup.

AltLayer's Restaked rollups use EigenLayer's restaking mechanism to improve the security of rollups.

We all know that re-staking is essentially to use the staking mechanism again to deposit ETH to enhance the security of other infrastructure other than the Ethereum main network. So for a Rollup, after it is built, it is easiest to Where do people feel unsafe?

It’s nothing more than whether the transaction can be confirmed quickly, whether the sequencer is centralized, and whether the transaction is really being verified by multiple parties.

Therefore, you can understand Restake Rollup as a lazy proof package that actively proves to the outside world that these places are safe.

The means of implementation is a set of vertically integrated Active Verification Services (AVS), which ensures its operation by staking the LST generated by pledging ETH to the following active verification services. At the same time, it also adds a layer to the self-built Rollup. A more reassuring safety lock.

In 2023, EigenLayer announced that it had received US$50 million in financing, led by Blockchain Capital, with participation from well-known VCs in the industry such as Coinbase Ventures, Polychain Capital, Bixin Ventures, and Hack VC.

Official website: https://www.eigenlayer.xyz/

Twitter: https://twitter.com/eigenlayer

io.net: Solana Ecosystem DePIN & AI

io.net is a decentralized computing network that enables the development, execution and scaling of ML (machine learning) applications on the Solana blockchain, leveraging the world's largest GPU clusters to allow machine learning engineers to do so at a lower cost. Obtain distributed cloud service computing power.

What makes io.net unique is its ability to quickly cluster GPU resources in different locations, allowing 50,000 to 70,000 GPUs to be aggregated into a cluster, enabling efficient communication between clustered GPUs. If users have enough resources, it is possible to build large language models through the platform.

It is reported that the product has been demonstrated to well-known companies such as OpenAI, Instacart and Uber.

io.net uses three products to involve users and computing power providers in this process to improve the user’s product experience:

IO Cloud: A page for deploying and managing decentralized GPU clusters;

IO Worker: Provides users with real-time insights into their computing, providing an operational and bird's-eye view of devices connected to the network, allowing them to monitor these devices and perform quick actions such as deleting and renaming devices.

IO Explorer: Provides a window into the inner workings of the network, such as complete visibility of network activity, vital statistics, data points, and rewarded transactions.

IO is the native token and protocol token of the io.net network. The main utility of tokens is in two aspects:

IO will serve as the main payment method in the io.net ecosystem, such as paying for GPU deployment costs. And every model deployed on io.net must make a tiny IO transaction for inference.

IO tokens are used to reward GPU contributors.

According to Shenzhen TechFlow, io.net has been favored by major VCs in the primary market.

Official website: https://io.net/

Twitter: https://twitter.com/ionet_official

Berachain: comes with MEME attributes, an EVM-compatible public chain in the Cosmos ecosystem

Berachain is an EVM-compatible Layer 1 built on the Cosmos SDK. It is characterized by its use of liquid consensus proof as the consensus mechanism.

Through Proof of Liquidity, users can stake blue-chip assets such as BTC, ETH, and stablecoins and delegate these assets to validators. At the same time, these pledged assets will be used to provide liquidity to the chain’s native virtualized AMM, making capital production more efficient. Therefore, users have fewer reasons to leave this public chain.

The Berachain token economy introduces a three-token system: $BERA — Gas token, $HONEY — stablecoin, $BGT — governance token. Among them, $BGT cannot be purchased in the secondary market. It is a non-transferable NFT, and the holder can receive a certain percentage of the fees generated on Berachain.

The project was initiated by four anonymous co-founders, who established an NFT collection Bong Bears in 2021, inspired by Olympus DAO, and has since continued to develop with strong community and MEME attributes.

On April 20, 2023, Berachain announced the completion of a $42 million Series A round of financing led by Polychain Capital.

Official website: https://www.berachain.com/

Twitter: https://twitter.com/berachain

Blast: Profitable L2, Operations Master

Whether it is Blur or Blast, they are like a sharp sword, changing the original battle situation and knocking the former king off the altar.

What is the most important measurement criterion for a Layer 2? Number of users or TVL? Blast tells everyone with practical actions that TVL is king.

While all Layer 2s are talking about technical narratives and plausibly describing the vision of "airdrop" to everyone, Blast is very simple and straightforward: a branded airdrop; the deposited ETH brings its own income.

Blast is the first L2 blockchain network that provides passive income for funds in Layer 2 accounts.

Specifically, when a user deposits funds into Blast, Blast will then use ETH for network-native staking (mainly on Lido) and automatically return the staking proceeds to users on Blast.

In addition to ETH, Blast also supports passive interest generation of stablecoins. The operating mechanism is that when users bridge stablecoins (such as USDC, USDT and DAI) to Blast, Blast will then deposit the corresponding stablecoins locked on the Layer 1 network into DeFi protocols such as MakerDAO, and use USDB (Blast’s native stable currency The proceeds will be automatically returned to users on Blast in the form of coins).

As of January 28, Blast TVL was $1.3 billion.

In addition to income, Mingpai’s airdrop expectations also make everyone flock to it: after users enter the Blast network through early access, they can not only immediately enjoy the passive interest earning of 4% of ETH or 5% of stablecoins, but also accumulate Blast Points rewards at the same time.

On January 17, Blast officially announced the launch of a test network and a one-month "Big Bang" incentive plan to encourage developers to build applications in its ecosystem. The winning project can receive Blast token airdrops.

For public airdrops, half is given to users and half is given to developers. There are users, liquidity (TVL), and airdrops. Developers have no reason not to work hard. This is equivalent to Blast completing the ecological construction path of other public chains for one or even several years only in the test network stage.

We are very much looking forward to what surprising gameplay Blast will offer in the future.

In November 2023, Layer2 network Blast completed US$20 million in financing, with Paradigm and Standard Crypto participating.

Official website: https://blast.io/zh-CN

推特:https://twitter.com/Blast_L2

維度:Cosmos生態的分級結算層

dYmension 是一個分級結算層,基于 Cosmos 構建。

“結算層”這個定義解釋起來有點抽象,先了解一下區塊鏈的三層架構:

Execution(執行層):事務處理和狀態計算。

Settlement&Consensus(結算層和共識層):執行協議規則,確保所有參與者都同意區塊鏈的順序和狀態。

數據(Data):確保發布的所有數據均可用。

Dymension將區塊鏈功能放松層級,從而實現了多個組合。Dymension的架構還包括執行層、結算層和共識層以及數據層。

與基于通用 Rollup 構建的 dApp 不同,構建為 RollApp 的應用程序擁有自己的自主權,自主權指從擁有區塊鏈執行層中獲得的控制權,但必須遵守基礎層協議規則。

Dymension與Celestia水質本周期中的定制Cosmos雙雄,TIA金,DYM銀,二者或將在價格等各方面有所聯動。

2023年2月9日,Dymension完成了670萬美元輪融資,由Big Brain種子控股和Stratos領投。

官網:https://dymension.xyz/

推特:https://twitter.com/dymension

注:論文創作于2024年1月,當時DYM尚未上線主網。