時間:2024-01-31|瀏覽:512

穩定幣供應量的增加表明購買力的增加,這為牛市周期仍然存在的論點提供了可信度。

預計四月份即將到來的比特幣減半將成為比特幣價格上漲的催化劑。

最近的一次調整導致比特幣(BTC)的價格從兩年高點 48,969 美元跌至低點 38,555 美元。 周二,比特幣 (BTC) 價格在調整后回升至 43,000 美元以上。

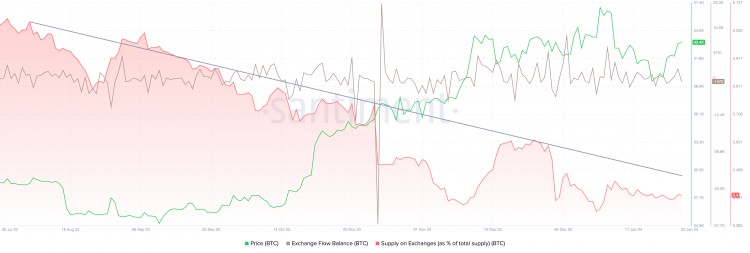

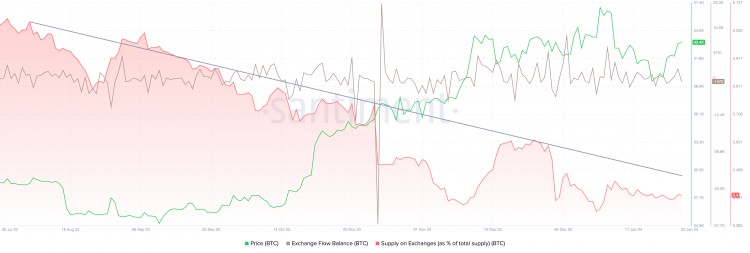

據加密貨幣情報追蹤機構 Santiment 的分析師稱,10 月份開始的比特幣牛市周期預計將持續下去。 這是因為自 8 月份以來,交易所的比特幣數量一直在波動。 外匯儲備減少被認為表明拋售壓力下降,這一事實支持了價格復蘇的概念。

市場動向每日概覽:交易供應減少可能有助于價格復蘇

交易所的比特幣供應量從8月份的6.05%下降到1月30日的5.40%,下降幅度很大。 供應減少通常會導致資產拋售壓力減少。 這是因為它表明更多的交易者選擇將比特幣保留在錢包中,而不是將其保留在交易所。

比特幣

自1月10日美國證券交易委員會決定批準現貨ETF以來,比特幣不斷從交易所錢包中下架。

加密貨幣情報追蹤機構 Santiment 的分析師觀察到,交易所上的比特幣數量正在逐漸減少。 在過去的五周里,穩定幣數量的增加與這一發展同時發生。

專家表示,交易所USDT儲備的增長被認為是購買力增強的跡象。 這表明十月份開始的中期牛市周期可能仍然存在。

比特幣(BTC)減半事件預計將于 4 月 18 日發生,該事件過去一直被認為是價格上漲的推動力。

Tether 在多個交易所的報價

It was believed that the withdrawal of Bitcoin from Grayscale's exchange-traded fund (ETF) was one of the primary contributors to the recent drop in the price of Bitcoin. The Spot Bitcoin ETF offered by Fidelity, on the other hand, had daily inflows of $208 million on Monday alone, according to statistics provided by investors from Farside. Since the day it was launched, this has been the first occasion that GBTC outflows have exceeded GBTC inflows. This has completely changed the narrative that this factor was likely affecting the drop in the price of BTC.

The Technical Analysis of: Prices of bitcoin are expected to recover to $45,000.

A recent upward trend in the price of bitcoin began in September and continues to this day. The price of Bitcoin (BTC) reached its highest level in two years on January 11, reaching $48,969, before falling to a low of $38,555. As of the time this article was written, the price of Bitcoin (BTC) was trading at $43,374, having made a return over the $43,000 barrier on Tuesday.

Bitcoin (BTC) is encountering resistance in the bearish imbalance zone, which extends between $43,870 and $45,562 and is located upward.