區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析

區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析時(shí)間:2024-01-29|瀏覽:303

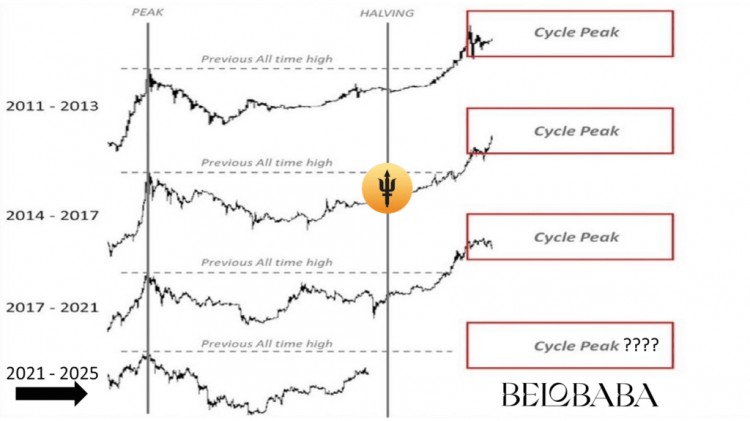

今天,在技術(shù)分析領(lǐng)域,從 BELOBABA 首席投資官 Jesús Sánchez-Bermejo 的手中,我們將了解比特幣周期、它的時(shí)代及其可能的演變。

首席投資官 Jesús Sánchez-Bermejo 的技術(shù)分析和操作

比特幣周期/比特幣時(shí)代

比特幣周期是指比特幣價(jià)格隨著時(shí)間的推移反復(fù)出現(xiàn)的增長(zhǎng)和下降模式。 盡管沒(méi)有固定的時(shí)間周期并且市場(chǎng)條件可能會(huì)發(fā)生變化,但一些分析師和觀察家注意到某些模式似乎在比特幣的歷史中重演。 值得注意的是,過(guò)去的周期并不能保證未來(lái)的結(jié)果,因?yàn)?a title='注冊(cè)送加密貨幣' target='_blank' class='f_d'>加密貨幣市場(chǎng)波動(dòng)性很大,并受到多種因素的影響。

以下是比特幣歷史周期的概述:

積累階段:

在此階段,投資者可能會(huì)在經(jīng)歷一段時(shí)期的下跌之后以相對(duì)較低的價(jià)格積累比特幣。

牛市階段:

這是比特幣價(jià)格急劇上漲的階段。 媒體關(guān)注度普遍增強(qiáng),吸引了新的投資者。

在牛市期間,可以觀察到比特幣價(jià)格的大幅上漲。

熊市階段:

達(dá)到頂峰后,市場(chǎng)可能會(huì)進(jìn)入以價(jià)格下跌為特征的看跌階段。 調(diào)整可能是快速而劇烈的,價(jià)格也會(huì)大幅下降。

在此期間,市場(chǎng)信心可能會(huì)下降,部分投資者可能會(huì)拋售以鎖定利潤(rùn)或限制損失。

鞏固階段:

在看跌階段之后,市場(chǎng)可能會(huì)進(jìn)入盤(pán)整階段,價(jià)格將保持在更窄的區(qū)間內(nèi)。 波動(dòng)性可能會(huì)下降,投資者可能正在評(píng)估市場(chǎng)的未來(lái)方向。

區(qū)塊鏈上的活動(dòng)可能顯示出投資和貨幣積累增加的跡象。

第四周期

在下圖中,我們觀察了迄今為止的 4 個(gè)比特幣周期(我們處于第四個(gè)周期中心點(diǎn)的退出區(qū)域)。 2022 年 11 月的最低區(qū)域似乎很重要,因?yàn)樗巧弦粋€(gè)加密貨幣冬天理論上秋天的最后區(qū)域。

Remember that whenever era 4 hits the ceiling/resistance, a new crypto winter would begin that must look for the new LH (low high/long-term continuation low) and it would be there, where in that area, the era fifth, it would have its minimum point/accumulation zone, to continue climbing in price, already in the fifth era. But for that, we should still have at least four years left, understanding that if we respect the entire historical structure that has already been carried out, during 2026 it should be, this year, the accumulation zone following 2022/2023.

But for that... there is still time, and now and in the fourth era, we are about to reach the new halving, which will mark the next page in the history of bitcoin, while the adoption of blockchain technology is arriving.

At BELOBABA we are convinced that regardless of the price of bitcoin, as a whole, blockchain technology will have greater weight every day in all sectors of society, even in the "big money", since we do not forget that bitcoin is a nail of approximately 0.8/0.9 trillion USD (American trillions are European trillions) and Real Estate with its almost 400 trillion USD will be a litmus test in the economic adoption of blockchain technology.

Comparison of Peak (ceilings), halving (reduction of the bitcoin mined block reward by half/new issuance of bitcoin) and Cycle Peak (ceilings reached after the halving of each era/cycle).

The halving is approaching and after it, the new movement of bitcoin will mark the future of the new highs (ATH/All Time High).

We still have little history in bitcoin (birth in 2009) but little by little we can study its past to try to shed a little more light on its theoretical future. We will continue to publish articles and reports on our vision of the market and technology, without forgetting that in these public articles, each person is responsible for their own investment decisions.

This content is for informational and educational purposes. There is no consumer protection. Your capital is subject to risks. It is not a recommendation to buy or sell crypto assets. Do your own research or contact your trusted financial advisor.

Cr