時間:2024-01-25|瀏覽:343

昨天,1月23日,也達到了目前的最低點。 大盤一度跌至38,600點。 要知道1月10日,比特幣現貨ETF公布,行情一度達到4.9萬。 僅用了12天,就達到了38000人。 目前跌幅已經達到了20%,也跌破了MA99線。 基本上已經進入短期下跌。 市場正在下行。 目前這一波的支撐其實是在41000點左右。 如果這一波支撐不住,那么下一波支撐位在37000點附近。 如果能忍住37000,可能會回到30000左右,所以我們還是要觀望這一波的走勢。

那么我們就來看看這波行情走勢的原因。

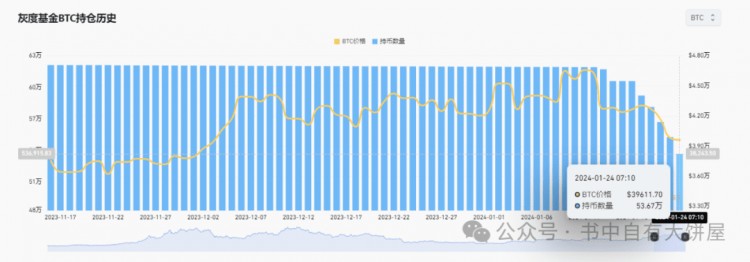

原因一:灰度砸盤

灰度GBTC成立已經10年了。 此前其結構是封閉式基金(對投資者吸引力不大,管理費高達1.5%,而目前現貨ETF管理費大多低于0.5%,有的只要求0.25%)。 事實上,截至美國證券交易委員會批準現貨比特幣ETF時,GBTC的資產規模已接近300億美元,因此當GBTC早期轉型為流動性更強的現貨ETF時,“股票”持有者毫不奇怪地選擇出售

Grayscale GBTC 于 1 月 11 日開始交易后,美股市場連續三個交易日共有 31,638 BTC(約 13.66 億美元)轉移至 Coinbase Prime。 。

1 月 16 日,Grayscale 將 9,000 BTC 轉移至 Coinbase Prime,價值約 3.8 億美元。

1 月 17 日,Grayscale 向 Coinbase Prime 轉移了 18,638 BTC,價值約 7.98 億美元。

1 月 18 日,Grayscale 將 9,840 BTC 轉移至 Coinbase Prime,價值約 4.18 億美元。

1 月 19 日,Grayscale 將 12,865 BTC 轉移至 Coinbase Prime,價值約 5.29 億美元。

1 月 22 日晚,標有“灰度:比特幣信托”的地址總共向 Coinbase 轉賬了 14,356 BTC,價值約 5.85 億美元,另外 3,950 BTC(價值約 1.6 億美元)被分配到了 4 個地址,預計將轉至Coinbase 很快(Coinbase Prime 地址的挖礦費用已收到)。

Because Grayscale used to be a Bitcoin product for futures ETFs, there would be a negative premium. The previous negative premium for Bitcoin was -40% at its highest, but now we see that the negative premium for GBTC is basically gone, and the ones that have been cleared recently are still What’s more powerful is that because you have a negative premium, others will definitely sell yours and replace it with a better spot ETF. This is why applications for spot ETFs have not been approved for so many years, but there are still so many institutions that persist. , we also said in the last market analysis (Bitcoin spot ETF passed or failed? Later market analysis), after the gold ETF passed, it led gold to a 10-year super bull market, and this wave of Bitcoin will not Poor.

Another interesting data here is that ETH still has a negative premium of 14%? Will eth continue to fall?

Reason 2: FTX sells GBTC stock

However, during the outflow of GBTC funds, one institution attracted the attention of the crypto community, and it was FTX. On the evening of January 22, two people familiar with the matter revealed that the bankrupt cryptocurrency exchange FTX sold off 22 million GBTC shares it held. A large part of it was a capital outflow worth up to US$1 billion. So far, FTX’s GBTC Ownership has been reset to zero.

According to a filing published by FTX on November 3, 2023, FTX holds shares of five Grayscale trust funds in the ED&F Man Capital Markets (now known as Marex Capital Markets Inc.) brokerage account, and another in Bitwise management Nearly 3 million shares are held in a statutory trust. Like many large cryptocurrency trading entities, FTX profited from the spread between the price of Grayscale Trust shares and the underlying Bitcoin net asset value in the fund. At the end of October 2023, FTX’s GBTC shares were only worth approximately 5.97 On the first day of trading on NYSE Arca, the closing price of the Grayscale Bitcoin ETF reached $40.69, which meant that the value of GBTC shares held by FTX had risen to about $900 million at that time.

Reason 3: Others

1. Good things come to fruition, which means bad things happen. Spot ETFs come to fruition through good things, and they have been rising for so long before. People who were long before made money casually. This wave must blow up these people, so that they can rise better.

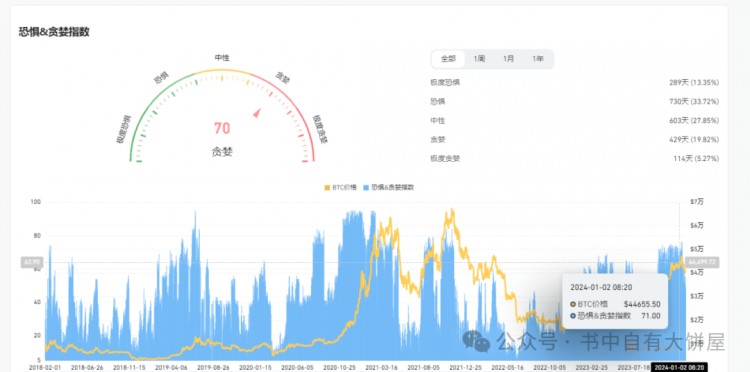

2. The indicators need to be pulled back. The previous greed indicator has always been over 70, which shows that many people are bullish and it is impossible for the market to follow the wishes of most people.

This wave of positive factors: spot ETF is officially launched

In the first two days of trading, the cumulative trading volume of spot ETFs reached $7.823 billion, with more than $1.4 billion in AUM inflows. This exceeds the $579 million in outflows from the now-converted GBTC ETF product, as investors reallocated funds after years of poor performance during the fund's time as a closed-end fund (and saw ETF fees fall from 2.0% to 1.5% ).

Despite these outflows, GBTC remains a significant player in the ETF market, with trading volume reaching $4.166 billion over the two trading days, accounting for 57% of total trading volume. It is likely that funds will continue to reallocate to GBTC in the coming weeks.

BlackRock, Fidelity, ARK and other institutions have also been buying recently. BlackRock alone has purchased 1.5 billion US dollars of BTC, Fidelity has bought 1 billion US dollars, Bitwise has bought 450 million US dollars, and Frankin has bought BTC. 500 million U.S. dollars, etc., these institutions combined to buy almost 4 billion U.S. dollars of BTC.

So this is a continued positive and nothing to worry about.

Grayscale currently has about 100,000 BTC, accounting for 15% of the total, so it currently has about 530,000 bitcoins, and the current total price is still 21 billion US dollars. Of course, if the market continues to fall, then its value It will also shrink.

He will definitely not sell all of them here, at least not in a short period of time, because these are all bought by investors, and investors do not want the assets they bought to shrink significantly. This is a question of balance. , as for how much they will sell, it depends on the capital of this group of people. If there is a profit, then it will be better to sell the ETF and exchange it for spot.

This wave of correction is actually a good thing, because everyone knows that there will be a big correction after the halving according to the previous market trend. Before, the intensity was more than 50%, but now as Bitcoin becomes bigger and more formal, this kind of correction will happen. A level correction may be more difficult, so a 30%-40% correction may be the limit in this wave.

As for this wave of callbacks, the current position we see is the support of 37,000, that is, a 25% drop from 49,000 to 37,000. If 37,000 cannot be held, the next position may be around 30,000, and 30,000 corresponds to It is the 40% retracement position, which is basically the limit of this wave.

After clearing out the long positions in this wave, the rest of the way will be smooth and you can rush forward in one go. However, you will definitely not be given too much time and opportunities. The opportunities will be fleeting. This is also a better boarding point for many friends who have not yet boarded the bus. Seize the opportunity.

At present, the main idea is to seize the big pie and Ethereum. Small currencies have not yet opened positions, so hurry up. Many of the potential currencies we talked about before have gone up, such as UMA, API3, ENS, PENDLE, etc. that have become popular recently. It has doubled many times, and our friends in the planet group are also very happy.

Summarize

This time the size of the new spot Bitcoin ETF has set a new record, and the industry has finally achieved results after ten years of hard work. After more than a decade of hard work against a backdrop of significant political, regulatory and financial headwinds, spot ETFs have finally reached the finish line.

These spot Bitcoin ETFs began trading, poetically, on the 15th anniversary of Hal Finney first tweeting “Run Bitcoin” on January 11, 2009. The first Bitcoin transaction between Satoshi Nakamoto and Hal occurred the next day, January 12, 2009.

Let’s review again what we learned about the gold ETF in our last program. This is a historical reference. After the gold ETF was passed, gold increased five times in 10 years. The most exaggerated increase was in the second quarter after the gold ETF was passed. Year, why do you think about it?