區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析

區(qū)塊鏈?zhǔn)澜?/font>區(qū)塊鏈智能合約的應(yīng)用和技術(shù)解析時(shí)間:2024-01-11|瀏覽:375

今天加密貨幣領(lǐng)域發(fā)生了什么:SEC 的 ETF 推文是否處于草案階段? 分析師這么認(rèn)為!

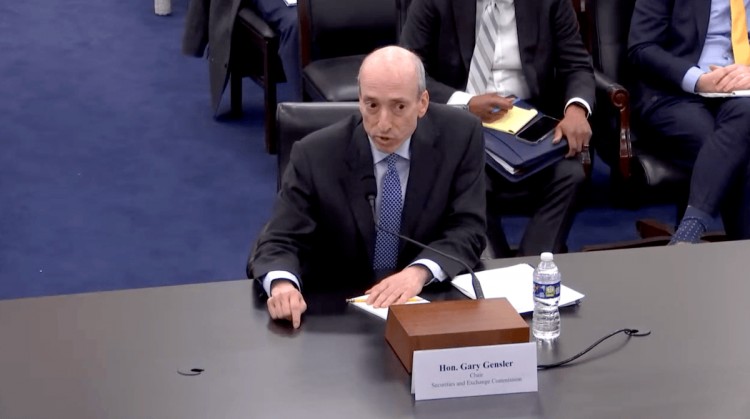

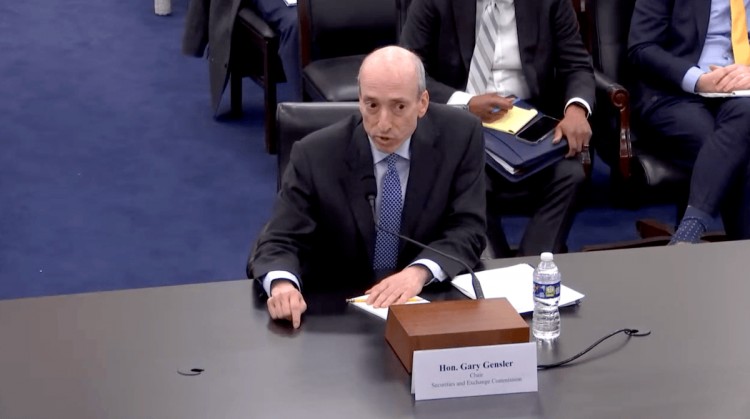

昨天,隨著 SEC 批準(zhǔn)現(xiàn)貨比特幣 ETF 申請(qǐng)的最后期限臨近,加密世界屏住了呼吸。 當(dāng) SEC 的官方 X 賬戶突然發(fā)推文“BTC ETF 獲批!”時(shí),價(jià)格飆升至 4.8 萬(wàn)美元。 但幾分鐘后這條推文就消失了,詹斯勒否認(rèn)有任何突破。 事實(shí)證明,該賬戶被黑客入侵,導(dǎo)致價(jià)格暴跌。

今天,我們的目標(biāo)是通過(guò)我們對(duì)頂級(jí)加密貨幣新聞的綜述,在混亂中提供一些理智。

總而言之:

SEC 賬戶被黑,BTC 坐過(guò)山車(chē)

預(yù)期 ETF 批準(zhǔn)的影響

離職的 Evmos 聯(lián)合創(chuàng)始人返還 760 萬(wàn)美元??

AI幣正在崛起

新加坡張開(kāi)雙臂歡迎加密貨幣

現(xiàn)在讓我們更深入地探討每個(gè)標(biāo)題——從 SEC 的錯(cuò)誤開(kāi)始,導(dǎo)致比特幣陷入瘋狂……

SEC 的錯(cuò)誤

昨天,當(dāng) SEC 的官方 X 賬戶突然投下一枚禁忌炸彈時(shí),一場(chǎng)混亂海嘯席卷了加密推特:

“BTC ETF 獲批!”

但幾分鐘后這條推文就消失了,讓社區(qū)陷入陰謀混亂。

Gensler 本人跳到網(wǎng)上否認(rèn) ETF 的任何突破,同時(shí)提出了“未經(jīng)授權(quán)的訪問(wèn)”的問(wèn)題。

一些人推測(cè)推文草稿是由瀏覽私人文件夾的流氓員工或黑客泄露的。

一些觀察人士認(rèn)為,泄露的推文可能是美國(guó)證券交易委員會(huì)安排在明天發(fā)布的,但今天卻錯(cuò)誤地提前發(fā)布了。

彭博社的知名分析師埃里克·巴爾丘納斯 (Eric Balchunas) 指出,所使用的語(yǔ)言本質(zhì)上非常“SEC 風(fēng)格”,表明這很可能是一份內(nèi)部草案。 因此,在他看來(lái),有人可能只是搞砸了日歷安排,導(dǎo)致 hopium 過(guò)早 24 小時(shí)到達(dá)互聯(lián)網(wǎng)。

不管怎樣,交易員們?cè)诨靵y中坐上了猛烈的過(guò)山車(chē)。 隨著買(mǎi)單涌入,比特幣飆升至 4.8 萬(wàn)美元。但一旦澄清消除了這種氛圍,比特幣就迅速回落至 4.5 萬(wàn)美元。

那么這個(gè)賬號(hào)真的被黑了嗎? 還有誰(shuí)同意埃里克的觀點(diǎn)? 閱讀完整的故事!

預(yù)期 ETF 批準(zhǔn)的影響

K33 Research 表示,一旦 SEC 支持比特幣現(xiàn)貨 ETF,上周的劇烈去杠桿化可能已經(jīng)為順利航行掃清了道路。

1 月 2 日至 6 日期間,永續(xù)資金轉(zhuǎn)為中性,未平倉(cāng)合約減少了 12%。

這表明市場(chǎng)有更堅(jiān)實(shí)的基礎(chǔ)來(lái)消化任何現(xiàn)貨 ETF 裁決,而無(wú)需進(jìn)行級(jí)聯(lián)清算。

此外,根據(jù) CME 60 億美元的未平倉(cāng)合約數(shù)據(jù),機(jī)構(gòu)樂(lè)觀情緒持續(xù)接近歷史高位。

那么當(dāng)美國(guó)證券交易委員會(huì)宣布其裁決時(shí),價(jià)格不會(huì)出現(xiàn)上漲和下跌嗎? 閱讀完整的故事!

這就是我們的每日一詞!

這就是“級(jí)聯(lián)清算”!

Cascading liquidations refer to a scenario in crypto trading when a series of forced liquidations of leveraged positions occur successively, triggering further liquidations. This happens when prices experience significant downside volatility.

As prices rapidly decline, leveraged long positions start becoming underwater, meaning the collateral deposited is no longer sufficient to meet the maintenance margin requirements on exchanges. This prompts exchanges to forcefully close out these positions to recoup funds.

These forced liquidations automatically trigger market sell orders that push prices even lower.

As prices continue to drop from these liquidations, more and more long positions are knocked out due to insufficient collateral, creating a cascading effect of successive liquidations being triggered.

The rapid dumping of leveraged positions creates substantial selling pressure, exacerbating price declines and volatility.

But what exactly triggers this event? Read more!

Now back to our daily stories!

It’s Time for AI Coins!

Per Binance Research, AI coins beat almost every category - second only to white-hot Ethereum layer 2 ecosystems.

When you filter noise from meme mania, AI coin gains hit 185%.

So which AI coins truly went interstellar?

Fetch.AI exploded by 659% in 2023 thanks to its decentralized machine-learning marketplace and autonomous agent network.

And SingularityNET wasn't far behind after its AI services emporium on Ethereum pumped 616%.

Clearly, AI adoption accelerated into light speed across crypto last year! Which other AI coins showed outstanding performance? Read the full story!

Evmos Co-Founder’s Good Faith ??

Departed co-founder Akash Khosla resurfaced bearing gifts of 59 million EVMOS tokens worth $7.6 million!

Khosla's peace offering aims to redistribute influence to current core contributors. Part of broader initiatives to bolster community trust and stabilize token value.

This Olive branch closure comes after Khosla's sudden departure last year over operational disagreements.

Will this token surrender help the price of EVMOS tokens? Read the full story!

Singapore’s Making Moves

Major regulatory moves by leading crypto custodian BitGo this week. The platform secured preliminary approval for a payments license from Singapore's central bank.

This stamp positions BitGo's Singapore outfit for full clearance to enable crypto services within the city-state. We're talking exchange offerings, web3 remittances, institutional client asset support and beyond!

Singapore is making moves to become the haven for crypto companies. Read the full story!

That wraps up today's top crypto headlines. See you tomorrow for more updates from this rapidly evolving space!

Before you head out, take a sec to sign up for our newsletter below, and we'll deliver the hottest crypto stories straight to your inbox!

Subscribe to Our Newsletter!

熱點(diǎn):etf 分析師 加密貨幣 加密貨幣領(lǐng)

![[加密365]這是今天加密貨幣領(lǐng)域發(fā)生的事情](/img/20240126/3290688-1.jpg)

![[加密藝術(shù)家]抵押不足貸款是否可能放手?野貓是這么認(rèn)為的](/img/20240106/3144819-1.jpg)

![[加密藝術(shù)家]抵押不足貸款是否可能放手?野貓是這么認(rèn)為的](/img/20240106/3144819-1.jpg)