時間:2024-01-01|瀏覽:390

Source: Warald

According to the New York Times, 23-year-old New York University student Jerry Yu (Yu Chengdong) is the owner of a Bitcoin mine in Texas that was acquired for more than $6 million last year.

And this Bitcoin mining farm, BitRush Inc. (aka BytesRush), was not purchased with U.S. dollars. Instead, it is purchased with cryptocurrency.

According to reports, Jerry Yu used Bitcoin mining farms to transfer funds to the United States without the government’s knowledge.

Picture source financial review copyright belongs to the original author

Since cryptocurrencies provide anonymity, transactions are conducted through offshore exchanges, which prevents anyone from knowing the source of the funds.

The move allows Chinese investors to avoid the U.S. banking system and federal regulators, as well as Chinese restrictions on capital outflows.

Built on an open field in Texas, the mine consists of dozens of buildings and houses 6,000 specialized computers.

After China banned all cryptocurrency trading and mining in September 2021, Bitcoin mining companies increasingly turned to places in the United States such as rural areas of Nebraska, Wyoming, and especially Texas.

Recent reporting in the New York Times suggests that these cryptocurrency mining farms are causing some worrying socioeconomic impacts.

Picture source financial review copyright belongs to the original author

BytesRush, a Bitcoin mining farm in Channing, Texas, owned by Jerry Yu, is facing a lawsuit over allegations that it failed to pay workers in full.

Another Texas-based cryptocurrency mining company, Crypton Mining Solutions, is also suing BytesRush, claiming the company failed to pay for services provided.

In an interview, Jerry Yu's attorney Gavin Clarkson pointed out that the company complies with all federal, state and local regulations, including banking regulations, and the contractor's claim that it has not received payment is "baseless."

Clarkson said that Crypton was actually the party owed money, and BytesRush accused it of "gross negligence" and demanded $750,000 in compensation.

Until recently, this little-known cryptocurrency mining farm was unexpectedly exposed because the contractor said it was in arrears with project payments. Jerry Yu’s identity and method of transferring large amounts of wealth across countries were unexpectedly exposed.

Jerry Yu is a Chinese national, but has the right of residence in the United States. From a life perspective, he is a real rich second generation.

Picture source: nytimes, copyright belongs to the original author

He was educated at a prep-school in Connecticut and entered New York University after graduation. His Manhattan apartment is worth $8 million and was previously owned by former General Electric CEO Jeffrey Immelt.

Last year, he bought a majority stake in the Channing cryptocurrency mine in Texas for $6 million.

The two people who signed the mortgage documents for Jerry Yu's Manhattan apartment were Yu Hao and Sun Xiaoying, whose names matched those of a Chinese couple who owned a company, according to records from business intelligence firm WireScreen. The stake is worth more than $100 million.

A person named Sun Xiaoying is also listed as a director of BytesRush. Jerry Yu's attorney would not confirm the identities of BytesRush shareholders or his possible relationship with any of them.

Such mines could burden the U.S. power grid, and the owners' Chinese citizenship has also raised national security concerns, the New York Times reported.

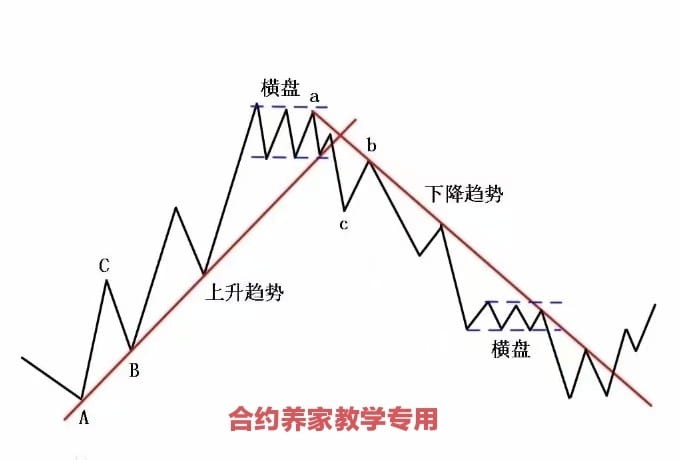

These mines are a way of producing cryptocurrency, primarily Bitcoin, and these are computers that run day and night trying to guess the correct sequence of numbers and thus obtain new Bitcoins, each of which is currently worth over $40,000.

Picture source network copyright belongs to the original author

The public funding trail ends at cryptocurrency exchange Binance.

By using a cryptocurrency called Tether and transferring funds through Binance’s offshore exchange, Jerry Yu kept the source of the funds completely hidden from his investors.

According to the U.S. government, Binance’s offshore operations were not complying with U.S. banking regulations at the time of the transactions.

Last month, we also reported that Binance admitted to violating anti-money laundering regulations and accepted more than $4.3 billion in fines and forfeitures.

The federal case centers on Binance’s failure to comply with laws including the Bank Secrecy Act. The law requires lenders to verify customer identities and flag suspicious fund transfers.

Many netizens wonder: Can a 23-year-old college student have such great ability?

Some netizens also think: The US Taxation Bureau is at work again!

What do you think about this? Welcome to leave a message to share your views!