時間:2024-03-21|瀏覽:413

On Thursday (March 21), Bitcoin fell back to the US$66,200 level, and Ethereum was quoted at US$3,450. Foreign media disclosed that the U.S. Securities and Exchange Commission is launching legal action to classify Ethereum as a security. BlackRock plans to launch the tokenization fund BUIDL to seize real-world asset tokenization (RWA) business opportunities and stimulate the surge in RWA track tokens such as ONDO and CFG.

The United States’ sudden “Ethereum as a security” action to set the tone

Fortune magazine cited U.S. companies that have received subpoenas related to the investigation as saying that the U.S. Securities and Exchange Commission is launching an aggressive legal campaign to classify ether as a security. The news follows the regulator’s approval of a slew of Bitcoin spot ETFs in January, a further blow to the crypto industry’s hopes that the agency would approve applications for Ethereum spot ETFs from BlackRock and other companies.

The SEC’s Ethereum investigation involves asking companies to provide documents and financial records of any dealings with the Ethereum Foundation, the nonprofit organization that oversees the governance and development of the eponymous blockchain.

The U.S. Securities and Exchange Commission’s investigation into the Switzerland-based Ethereum Foundation follows the blockchain’s move to new governance called “Proof-of-Stake” (PoS) in September 2022, according to a person at a company that recently received a subpoena request. Mode started shortly after. Another company that received a subpoena described it as narrow in scope and focused on the Ethereum Foundation, saying it had received the subpoena within the past few weeks.

According to people familiar with the subpoenas at three different companies, that proof-of-stake incident moved the blockchain away from the energy-intensive model used by Bitcoin and toward one that relies on a network of trusted validators and provided the SEC with Provides a new excuse to try to define Ethereum as a security.

The people asked Fortune not to identify them or their companies out of fear of retaliation from SEC Chairman Gary Gensler, who some say is "vindictive."

CoinDesk reported on the investigation into the Ethereum Foundation on Wednesday, citing an update to the group’s Github code repository that reportedly provided evidence of an investigation by an unknown country agency.

News of the subpoenas comes as the Securities and Exchange Commission and President Joe Biden's administration are aggressively cracking down on the cryptocurrency industry, which they view as a lawless industry. However, the movement has at times been frustrated by cryptocurrencies' murky legal status, which has led to a series of court battles over whether the SEC has jurisdiction over the industry.

This key jurisdictional question hinges on whether a particular cryptocurrency is a security, an issue that has not yet been explicitly resolved by the courts. Although Bitcoin is generally considered a commodity, Gensler, who is overseen by the Commodity Futures Trading Commission (CFTC), has said his agency treats the vast majority of other cryptocurrencies as securities that must be registered with the SEC.

The SEC has raised this point in recent court cases, except for Ethereum, whose legal status is murkier and whose security status has long been a point of contention for the agency.

Speaking at a conference in 2018, William Hinman, a former director of the Securities and Exchange Commission, said that ether is not like a security. Emails released as part of a trial over the issuance of XRP by Ripple show that SEC staff carefully considered how to express this claim clearly.

That changed under Gensler’s leadership of the SEC in 2021 and Ethereum’s move to proof-of-stake the following year.

At the time, Gensler said that any crypto-asset generated by a blockchain using a proof-of-stake model would likely be similar to an investment contract and therefore classified as a security, although he did not talk about any specific currency. In March 2023, he again suggested that proof-of-stake tokens could be regulated as securities, although he has since declined to comment specifically on Ethereum, including during an SEC oversight hearing before the House Financial Services Committee.

In October 2023, the problem became more complicated after the U.S. Securities and Exchange Commission approved nine ETFs tracking the Ethereum futures market, which is regulated by the U.S. CFTC, indicating that Ethereum is a commodity. U.S. CFTC Chairman Rostin Behnam has repeatedly stated that his agency treats ether as a commodity.

But in February this year, the controversial cryptocurrency company Prometheum announced plans to provide custody services for Ethereum as a security regulated by the U.S. Securities and Exchange Commission, which once again added uncertainty to Ethereum’s regulatory status. One recipient of a recent subpoena speculated that Gensler was trying to use Prometheum as a Trojan horse to classify ether as a security.

The issue has been thrust into the spotlight recently as major financial firms, including Fidelity and BlackRock, raced to gain approval for Ethereum spot ETFs, with all signs pointing to the SEC rejecting these ahead of the May deadline. Apply.

Bloomberg analysts noted that agency staff did not go back and forth with issuers on details about the potential, as they did with the Bitcoin spot ETF approved in January. A potential declaration that ether is a security could cast further doubt on the process, particularly as it would raise questions about the regulation of the U.S. CFTC’s ether futures market.

BlackRock set off a surge in the RWA track in one fell swoop

After successfully launching the Bitcoin Spot ETF (IBIT), the asset management giant BlackRock (BlackRock), which manages US$9 trillion, currently has a Bitcoin holding value of more than US$15 billion, second only to GBTC. In November 2023, the company also applied for an Ethereum spot ETF, which has been postponed twice.

BlackRock recently submitted Form D documents to the U.S. Securities and Exchange Commission and plans to launch the BlackRock USD Institutional Digital Liquidity Fund (BlackRock USD Institutional Digital Liquidity Fund) in cooperation with the U.S. asset tokenization company Securitize. This marks BlackRock’s first An asset tokenization fund is about to be launched, moving towards the field of real-world asset tokenization.

Asset management companies file Form D with the SEC under an exemption from the Securities Act, which allows companies to sell to accredited investors or a limited number of non-accredited investors without registering with the SEC. Offer and sell securities.

Documents show that BlackRock registered the fund in the British Virgin Islands in 2023 and set a minimum investment threshold of US$100,000. Securitize was responsible for the issuance and sales, and the sales commission reached US$525,000. However, the size of the fund has not yet been disclosed, nor what assets it will hold.

According to Etherscan information, the fund’s token name on Ethereum is BUIDL. Currently, the token has only one holder and its chain value is zero. According to CoinDesk, $100 million worth of USDC stablecoins on Ethereum were transferred to addresses associated with Securitize deployers, which may be a seed investment in the fund.

BlackRock CEO Larry Fink said in an exclusive interview with Bloomberg that the tokenization of real-world assets will be the next step for BlackRock. "We believe that the next step will be the tokenization of financial assets, which means that each stock and bond will be recorded on a general ledger."

In Fink’s view, through tokenization, it will be possible to get rid of all the current problems surrounding bonds, stocks and digital illegal activities. Most importantly, it will be possible to achieve instant settlement through tokenization and customize it to suit everyone. Personal investment strategy. He explained: “If you have a tokenized security and you have a tokenized identity, when you buy or sell an instrument, it is recorded on a jointly established ledger. Think about money laundering and other issues. Through a tokenized system, all corruption will be eliminated.”

Fink also emphasized in the interview: "Bitcoin and Ethereum spot ETFs are just a stepping stone towards tokenization, and I do believe this is the direction we are going to go."

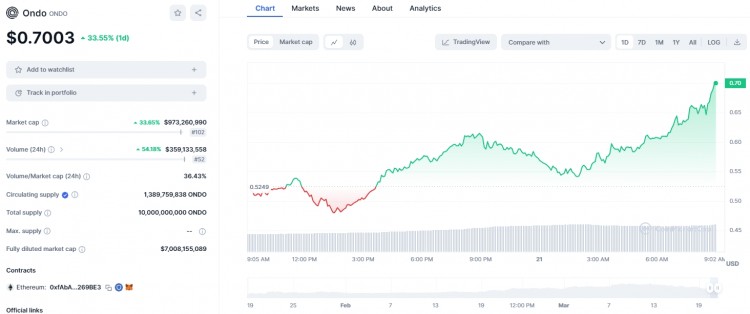

After the news that BlackRock plans to launch the tokenized fund BUIDL, the RWA track tokens in the currency circle rose against the trend. Ondo Finance token ONDO rose to 0.7003, a single-day increase of 33.55%, and the Centrifuge token CFG also increased by a breakthrough 10%.

Bitcoin technical analysis

Lockridge Okoth of FXStreet said Bitcoin prices have plummeted 17% since peaking at $73,777 and bottoming at $60,775. The weekly imbalance (FVG) is 3% below the average 20% retracement, creating an effective pull on the Bitcoin price to fill the inefficiency.

In this way, Bitcoin price could fall by 6% from current levels to reach the FVG upper limit of $59,005. If this level fails to hold support, Bitcoin could drop to the midline of the zone at $56,152. A breakout and close below this level could result in Bitcoin providing another buying opportunity near the psychological $50,000 level.

Watch out for the U.S. Dollar Index, which deviates from its downward trend as it attempts to fly or take off, which is another warning sign for Bitcoin holders. In hindsight, every time this overlay comparison spiked (bullish), the result was almost always bearish for Bitcoin.

The Relative Strength Index (RSI) has also fallen below 70, which some may interpret as a sell signal, with its directional bias combined with the red histogram of the Momentum Oscillator (AO) showing downward momentum.

On the other hand, if bulls enter the market at current levels, Bitcoin price could rise, potentially revisiting the $69,000 mark. A closing price above this level will usher in a sustained rebound, and Bitcoin may return to its all-time high of $73,777. In a highly bullish scenario, Bitcoin price could extend its gains and hit higher peaks.